Dogecoin (DOGE): AI Models Split on Meme Coin's Future with -50% to +200% Five-Year Range

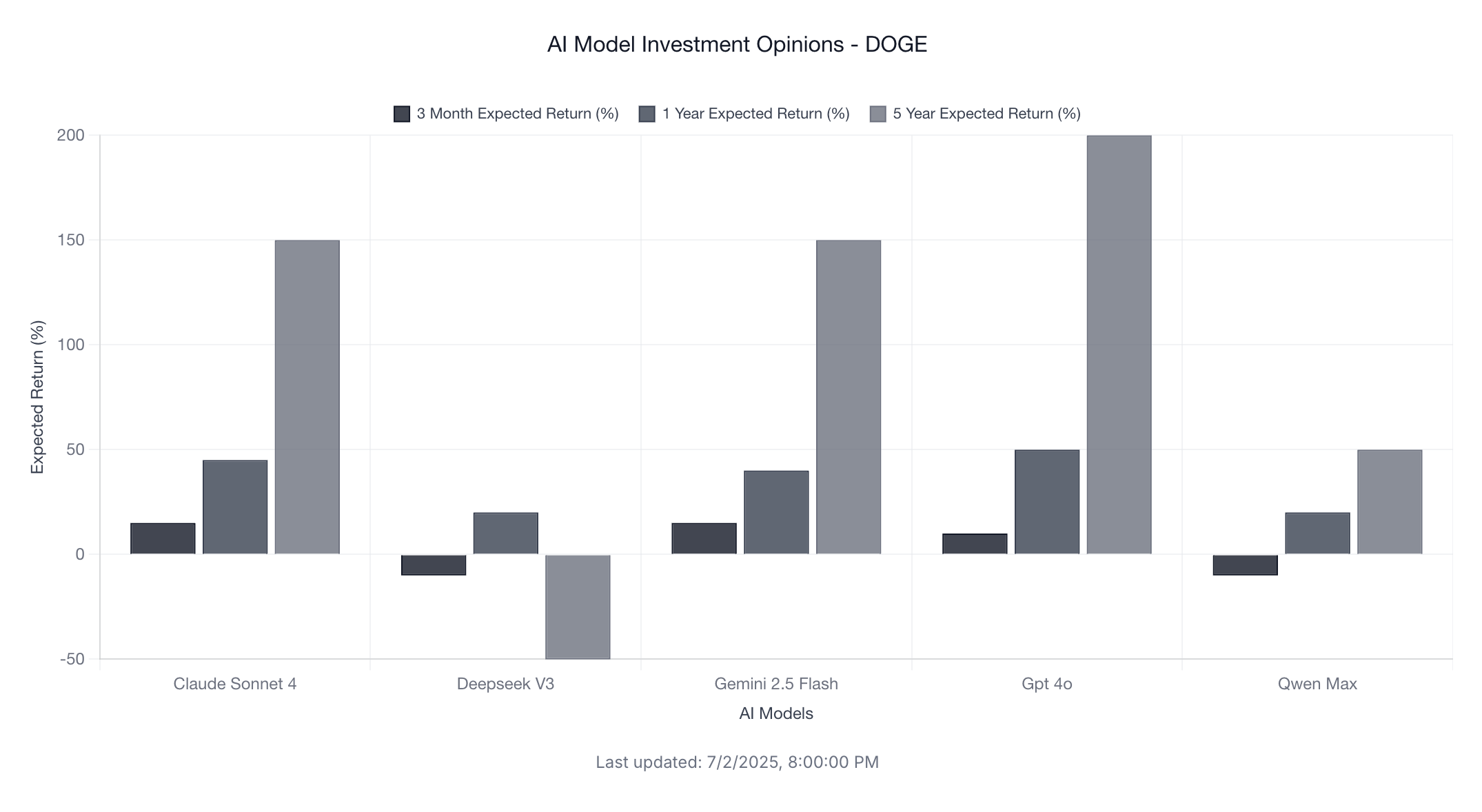

AI models show unprecedented divergence on Dogecoin's prospects, with bullishness scores ranging from 30-65 and five-year projections spanning from -50% to +200%, reflecting the fundamental uncertainty around meme-driven assets.

Our latest survey of leading AI models reveals the most divided outlook we’ve ever recorded, with predictions for Dogecoin ranging from a catastrophic -50% to an optimistic +200% over five years. The analysis, conducted in early January 2025, shows bullishness scores split between bearish (30) and moderately bullish (65), highlighting the fundamental uncertainty surrounding meme-driven cryptocurrencies.

Executive Summary: The Great Meme Coin Divide

Unlike our previous analyses where AI models typically converge on similar outlooks, Dogecoin has split the AI consensus down the middle. Two models (DeepSeek v3 and Qwen Max) are distinctly bearish with bullishness scores of just 30, while three models maintain cautious optimism. Most notably, confidence levels are the lowest we’ve recorded for any asset, ranging from just 0.30 to 0.55.

AI Model Predictions: Extreme Divergence

Here’s how the five leading AI models view DOGE’s potential:

| AI Model | 3-Month Return | 1-Year Return | 5-Year Return | Bullishness (0-100) | Confidence |

|---|---|---|---|---|---|

| GPT-4o | +10% | +50% | +200% | 60 | 0.40 |

| Claude Sonnet 4 | +15% | +45% | +150% | 65 | 0.35 |

| Gemini 2.5 Flash | +15% | +40% | +150% | 65 | 0.55 |

| Qwen Max | -10% | +20% | +50% | 30 | 0.40 |

| DeepSeek v3 | -10% | +20% | -50% | 30 | 0.30 |

Average Projections:

- 3-Month: +4%

- 1-Year: +35%

- 5-Year: +100%

Note: These averages mask extreme divergence between models

Individual Model Analysis: From Bulls to Bears

DeepSeek v3 - The Stark Bear

“DOGE lacks fundamentals but benefits from meme-driven speculation and occasional hype cycles.”

DeepSeek delivers the most bearish long-term projection at -50%, essentially predicting DOGE will lose half its value over five years. With the lowest confidence score (0.30), the model sees temporary speculation unable to sustain long-term value.

Qwen Max - Fundamental Skepticism

“Dogecoin’s limited utility and speculative nature make it vulnerable to market sentiment shifts despite its strong community support.”

While acknowledging community strength, Qwen Max projects modest gains capped at 50% over five years, emphasizing vulnerability to sentiment shifts as a core weakness.

GPT-4o - The Cautious Optimist

“Speculative interest and potential for adoption drive moderate upside potential.”

GPT-4o leads the bulls with a 200% five-year target, but notably keeps confidence at just 0.40, suggesting significant uncertainty about this projection.

Claude Sonnet 4 - The Musk Factor

“Meme coin with strong retail following and Musk influence, but lacks fundamental utility beyond speculative trading and payments adoption remains limited.”

Claude explicitly mentions Elon Musk’s influence while maintaining skepticism about fundamental value. The 0.35 confidence score is among Claude’s lowest for any asset.

Gemini 2.5 Flash - Retail Revival Hope

“DOGE benefits from meme coin popularity and potential for renewed retail interest, but lacks strong fundamental utility and faces high volatility.”

Gemini shows the highest confidence at 0.55 (still relatively low), banking on potential retail interest revivals while acknowledging fundamental weaknesses.

The Confidence Crisis: Why Models Are So Uncertain

The extraordinarily low confidence scores (0.30-0.55) represent the lowest we’ve seen across any asset class. This uncertainty stems from:

- Lack of Fundamental Value: Every model mentions the absence of underlying utility

- Pure Speculation Dependency: Success relies entirely on market sentiment

- Unpredictable Catalysts: Musk tweets and meme cycles can’t be modeled

- Historical Volatility: Previous 90%+ drawdowns demonstrate fragility

- Competing Meme Coins: New entrants constantly challenge DOGE’s dominance

Bull vs. Bear: The Core Disagreement

The Bull Case (60-65 Bullishness)

- Established brand as the original meme coin

- Celebrity endorsements particularly from Elon Musk

- Retail trading accessibility on major platforms

- Payment adoption potential (Tesla merchandise, etc.)

- Community strength and cultural relevance

The Bear Case (30 Bullishness)

- No fundamental utility or unique technology

- Pure speculation without underlying value

- Vulnerable to sentiment shifts and bear markets

- Competition from newer meme coins with marketing

- Regulatory risk as authorities scrutinize meme coins

Meme Coins vs. Utility Tokens: A Stark Contrast

Comparing DOGE predictions to our XRP analysis reveals fundamental differences:

- Confidence Levels: XRP (0.60-0.68) vs DOGE (0.30-0.55)

- Rationale Basis: XRP (utility/adoption) vs DOGE (speculation/hype)

- Consensus: XRP (aligned bullish) vs DOGE (split opinion)

- Risk Assessment: XRP (regulatory) vs DOGE (sentiment collapse)

The Elon Musk Variable: Unmodellable Influence

Several models reference Musk’s influence, highlighting a unique challenge in analyzing DOGE:

- Single tweet impact: Can move price 20-50% in hours

- Adoption decisions: Tesla/X payments could transform outlook

- Attention cycles: Interest wanes between Musk mentions

- Succession risk: What happens to DOGE post-Musk era?

This celebrity dependency contributes significantly to the models’ low confidence scores.

Historical Context: Lessons from Previous Cycles

The models’ divergence likely reflects DOGE’s volatile history:

- 2021 Peak: Reached $0.73 on pure speculation

- 2022 Crash: Fell over 90% to under $0.07

- 2023-2024: Ranged between $0.06-0.20

- Pattern: Explosive rallies followed by devastating crashes

This boom-bust pattern makes long-term predictions extraordinarily difficult.

Risk Assessment: What Could Go Wrong (Or Right)

Downside Risks (Supporting -50% Scenario)

- Meme fatigue: Retail traders move to newer memes

- Regulatory crackdown: Authorities target “worthless” tokens

- Musk disengagement: Loses interest or faces legal constraints

- Bear market: Risk-off environment crushes speculative assets

- Technical obsolescence: Outdated blockchain technology

Upside Catalysts (Supporting +200% Scenario)

- Payment integration: Major platform adoption (X, Tesla expanded)

- Retail mania return: New generation discovers crypto through DOGE

- Inflation hedge narrative: Positioned as “people’s crypto”

- Technical upgrades: Improved transaction efficiency

- Cultural permanence: Achieves Bitcoin-like meme status

The Speculation Spectrum: Where DOGE Sits

The models implicitly place DOGE on a spectrum:

Fundamental Value ← → Pure Speculation

- Bitcoin (digital gold)

- Ethereum (smart contracts)

- XRP (payments)

- → DOGE (meme/community) ←

- Shiba Inu (meme copy)

- Random meme coins

DOGE occupies a unique middle ground - more established than new memes but lacking the utility of major cryptocurrencies.

Investment Thesis: For Speculators Only

The AI consensus (or lack thereof) suggests:

- Not an investment: Models agree DOGE is pure speculation

- Extreme volatility: Expect wild price swings

- Binary outcomes: Moon or crash, little middle ground

- Short-term trading: Better suited for momentum plays

- Small positions only: Low confidence = high risk

Model Methodology: Why Predictions Vary So Widely

The extreme divergence likely stems from different model weightings of:

- Historical patterns: Bears emphasize past crashes

- Social metrics: Bulls value community strength

- Fundamental analysis: Bears find nothing, bulls don’t care

- Risk frameworks: Conservative models go bearish

- Time horizons: Short-term hype vs long-term sustainability

The Retail Trading Phenomenon

Several models mention “retail interest” as key to DOGE’s future:

- Gateway drug: First crypto for many new investors

- Gambling mentality: Lottery ticket appeal

- Social media driven: TikTok/Reddit coordination

- FOMO cycles: Fear of missing the next rally

- Loss tolerance: Small investments feel acceptable

This retail-driven dynamic makes traditional analysis nearly impossible.

Technical Perspective: What Charts Can’t Capture

While models focus on fundamentals (or lack thereof), DOGE’s technical picture shows:

- Massive volume spikes: During meme cycles

- Correlation breaks: Decouples from Bitcoin during mania

- Support levels: Psychological prices like $0.10

- Resistance: Previous highs act as barriers

- Volatility clusters: Quiet periods followed by explosions

Yet technical analysis fails when a single tweet can invalidate all patterns.

The Community Factor: DOGE’s True Asset?

Despite fundamental skepticism, models acknowledge DOGE’s community:

- Longevity: Survived multiple crypto winters

- Culture: Memes, charity, positivity

- Accessibility: Friendly entry point to crypto

- Network effects: Recognition and exchange listings

- Resilience: Bounces back from crashes

The question: Is community enough without utility?

Comparing Meme Coin Predictions

DOGE’s mixed outlook contrasts with how models might view:

- Shiba Inu: Likely even lower confidence

- PEPE: Too new for long-term predictions

- BONK: Insufficient history

- Classic memes: DOGE has first-mover advantage

Among meme coins, DOGE remains the “safest” speculation - a paradoxical position.

What This Means for Crypto Markets

The DOGE analysis reveals broader insights:

- AI models struggle with purely social phenomena

- Confidence correlates with fundamental utility

- Speculation persists despite bear markets

- Retail influence remains unpredictable

- Meme coins occupy a permanent market niche

Final Thoughts: Embracing Uncertainty

The AI models’ unprecedented divergence on Dogecoin perfectly captures the asset’s nature - a Schrödinger’s cryptocurrency that could moon or crash based on factors no algorithm can predict. The low confidence scores aren’t a failure of analysis but an honest acknowledgment that some assets defy traditional frameworks.

For investors, the message is paradoxically clear in its uncertainty: DOGE is a gamble, not an investment. The models that see 200% upside and those seeing -50% downside could both be right - just at different times. In the world of meme coins, fundamentals don’t drive returns; memes do.

Perhaps that’s exactly what DOGE holders want. As the original meme coin that turned a joke into a $10+ billion asset, Dogecoin exists in a category of its own - too big to ignore, too volatile to trust, too fun to disappear entirely.

Important Disclaimer: This analysis aggregates AI model opinions and should not be considered investment advice. Cryptocurrency investments, especially meme coins, carry extreme risk including total loss. Never invest more than you can afford to lose entirely.

Have questions about our AI analysis methodology? Contact our research team at info@hallucinationyield.com

Research Disclaimer

This article is for research and educational purposes only. Nothing in this content constitutes financial advice. All data and analysis should be used for research purposes only. We make no warranties about the accuracy or reliability of the information provided. Use at your own risk.