Ethereum (ETH): AI Models Unite with 180-300% Five-Year Targets on DeFi and Staking Fundamentals

Leading AI models show strong consensus on Ethereum's future, with bullishness scores of 65-75 and five-year projections of 180-300%, driven by institutional adoption, deflationary mechanics, and ecosystem dominance.

import { Tweet } from ‘astro-embed’;

Our latest survey of leading AI models reveals remarkable consensus on Ethereum’s prospects, with all five models demonstrating bullish sentiment and five-year return projections clustering between 180% and 300%. The analysis, conducted in early January 2025, shows bullishness scores ranging from 65 to 75 out of 100, with confidence levels notably higher than typical crypto assets at 0.60-0.65.

Executive Summary: The Smart Contract Platform Consensus

In stark contrast to the divided opinions on meme coins like Dogecoin, AI models show strong alignment on Ethereum’s fundamental value proposition. The consensus centers on three key pillars: institutional adoption momentum, deflationary tokenomics post-Merge, and ecosystem network effects from DeFi and NFT dominance.

AI Model Predictions: Unified Bullishness

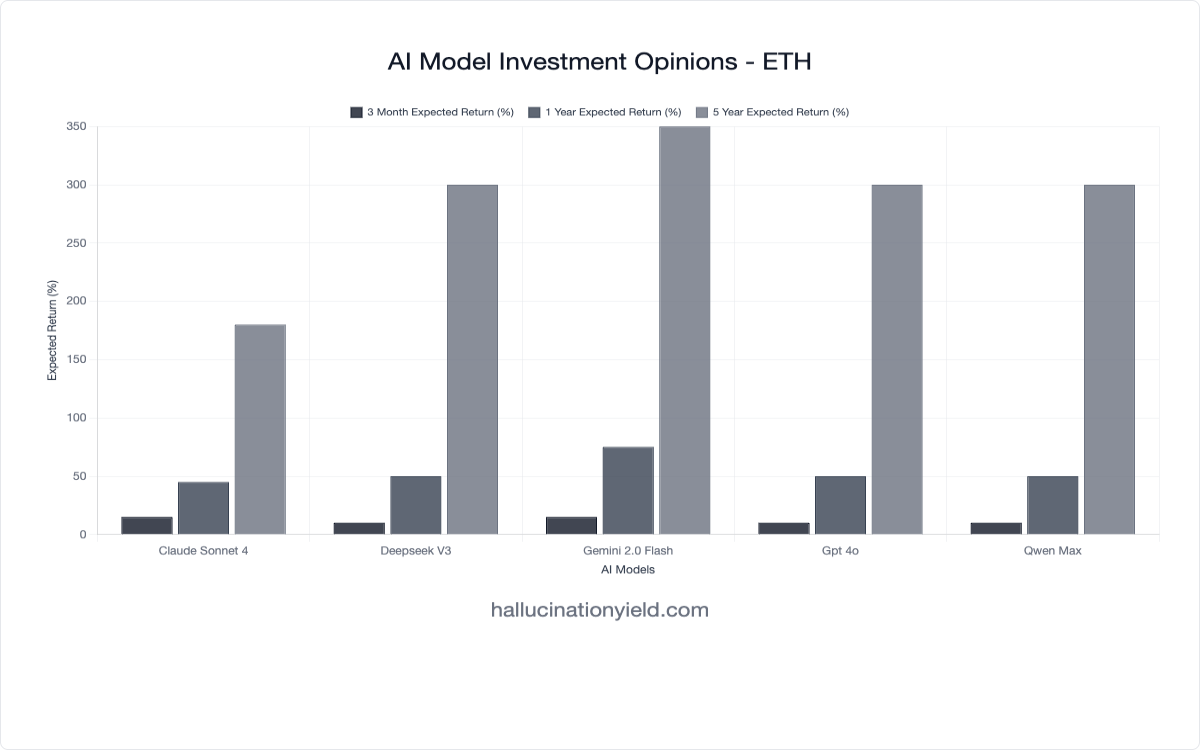

Here’s how the five leading AI models view ETH’s potential:

| AI Model | 3-Month Return | 1-Year Return | 5-Year Return | Bullishness (0-100) | Confidence |

|---|---|---|---|---|---|

| DeepSeek v3 | +10% | +50% | +300% | 65 | 0.60 |

| GPT-4o | +10% | +50% | +300% | 75 | 0.60 |

| Qwen Max | +10% | +50% | +300% | 75 | 0.65 |

| Gemini 2.5 Flash | +15% | +40% | +250% | 75 | 0.65 |

| Claude Sonnet 4 | +15% | +45% | +180% | 72 | 0.65 |

Average Projections:

- 3-Month: +12%

- 1-Year: +47%

- 5-Year: +262%

Individual Model Analysis: Nuanced Optimism

GPT-4o, DeepSeek v3, and Qwen Max - The 300% Club

GPT-4o:

“Ethereum’s strong network effects and upcoming upgrades position it well for long-term growth despite short-term volatility.”

DeepSeek v3:

“ETH’s long-term potential is strong due to its utility and adoption, but short-term volatility is high amid macro uncertainty.”

Qwen Max:

“Ethereum’s transition to proof-of-stake and growing adoption in DeFi and NFTs support long-term growth, though macroeconomic uncertainty and regulatory risks temper short-term expectations.”

These three models converge on 300% five-year returns, emphasizing network effects and continued technical development.

Gemini 2.5 Flash - The Deflationary Thesis

“Ethereum’s strong ecosystem, deflationary mechanics post-merge, and potential for institutional adoption position it for significant long-term growth despite short-term volatility.”

Gemini explicitly highlights the deflationary mechanics introduced by EIP-1559 and the Merge, projecting 250% returns.

Claude Sonnet 4 - The Conservative Bull

“ETH benefits from institutional adoption, staking yield, and deflationary tokenomics despite regulatory headwinds and macro uncertainty.”

Claude offers the most conservative projection at 180%, while emphasizing staking yield as an additional value driver beyond price appreciation.

The Confidence Sweet Spot: 0.60-0.65

Unlike the extreme uncertainty seen with Dogecoin (0.30-0.55) or the moderate confidence with XRP (0.60-0.68), Ethereum’s confidence scores cluster tightly at 0.60-0.65. This suggests:

- Fundamental agreement on value drivers

- Acknowledgment of crypto volatility without excessive doubt

- Balanced risk assessment between innovation and challenges

- Mature market understanding of Ethereum’s position

Key Themes: The Ethereum Investment Thesis

1. Institutional Adoption Acceleration

Every model references institutional interest, driven by:

- ETF approvals creating easier access

- Staking yields attracting institutional capital

- Enterprise blockchain adoption via private chains

- Regulatory clarity improving in major markets

2. Deflationary Tokenomics Revolution

The Merge and EIP-1559 created a new economic model:

- Proof-of-Stake reducing new ETH issuance

- Fee burning creating deflationary pressure

- Staking lockups reducing circulating supply

- “Ultra-sound money” narrative gaining traction

3. Ecosystem Dominance

Models emphasize Ethereum’s network effects:

- DeFi protocols with billions in TVL

- NFT marketplaces built on Ethereum

- Layer 2 scaling solutions expanding capacity

- Developer mindshare and tooling maturity

4. Technical Roadmap Confidence

References to “upcoming upgrades” reflect faith in:

- Sharding implementation for scalability

- Layer 2 integration improvements

- Account abstraction for better UX

- Continued innovation from core developers

Ethereum vs. Bitcoin: The Utility Argument

Comparing ETH predictions to typical Bitcoin analysis reveals different value propositions:

- Growth potential: ETH (262% avg) typically exceeds BTC projections

- Use cases: Smart contracts vs. store of value

- Yield generation: Staking rewards vs. no native yield

- Supply dynamics: Deflationary vs. fixed supply

- Volatility: Higher beta for ETH acknowledged

Risk Factors: What Could Derail the Thesis?

Despite bullishness, models acknowledge several risks:

Regulatory Headwinds

- Securities classification risk in some jurisdictions

- Staking regulation potentially limiting institutional participation

- DeFi crackdowns affecting ecosystem value

Technical Challenges

- Scalability delays if upgrades face setbacks

- Competition from newer Layer 1 blockchains

- Complexity increasing barrier to entry

Macro Environment

- Crypto winter scenarios affecting all digital assets

- Interest rate impacts on risk asset valuations

- Liquidity concerns during market stress

The Layer 2 Ecosystem: Scaling the Vision

Models implicitly factor in Ethereum’s Layer 2 strategy:

- Arbitrum and Optimism processing millions of transactions

- Polygon’s hybrid approach attracting major brands

- zkSync and StarkNet pushing technical boundaries

- Base bringing Coinbase users on-chain

This modular scaling approach differentiates Ethereum from monolithic competitors.

Staking Economics: The Yield Component

Claude’s specific mention of “staking yield” highlights an underappreciated factor:

- Current yields: 3-5% APR in ETH terms

- Institutional appeal: Yield-generating digital asset

- Supply dynamics: ~30% of ETH staked and growing

- Compound effects: Yield plus appreciation potential

DeFi and NFTs: The Killer Apps

Multiple models cite DeFi and NFT adoption as growth drivers:

DeFi Metrics

- $50+ billion TVL across protocols

- Lending, trading, derivatives use cases

- Institutional DeFi emerging slowly

- Real-world assets being tokenized

NFT Evolution

- Beyond profile pictures to utility NFTs

- Gaming assets and metaverse integration

- Brand engagement tools for enterprises

- Creator economy infrastructure

Price Targets: Modeling the Upside

Based on current ETH prices (~$2,400), the model projections suggest:

- Conservative (180%): ~$6,720

- Consensus (262%): ~$8,688

- Optimistic (300%): ~$9,600

These targets imply ETH could challenge the $1 trillion market cap threshold.

The Macro Crypto Thesis

The models’ ETH bullishness reflects broader crypto adoption assumptions:

- Digital asset acceptance by traditional finance

- Generational wealth transfer to crypto-native investors

- Central bank digital currencies validating blockchain

- Web3 infrastructure becoming essential

- Tokenization of everything gaining momentum

Investment Implications: Beyond Price Appreciation

The AI consensus suggests multiple ways to approach ETH:

- Buy and hold for long-term appreciation

- Stake for yield plus upside potential

- DeFi participation for enhanced returns

- Layer 2 exposure for higher beta plays

- Ecosystem investment in ETH-based projects

Model Convergence: What It Means

The tight clustering of predictions (unlike DOGE’s chaos) suggests:

- Mature understanding of Ethereum’s value proposition

- Consensus on fundamentals despite different models

- Reduced speculation compared to meme coins

- Institutional mindset in evaluation approach

Technical Development: The Innovation Engine

Ethereum’s continuous evolution drives model confidence:

- EIP-4844 (Proto-Danksharding) reducing L2 costs

- Account abstraction improving user experience

- Statelessness research for better scalability

- MEV mitigation protecting users

- Quantum resistance planning

Comparing Predictions: ETH vs Other Cryptos

Our AI model surveys show distinct patterns:

- ETH: High confidence (0.60-0.65), strong consensus

- XRP: Moderate confidence, regulatory focus

- DOGE: Low confidence (0.30-0.55), extreme divergence

- BTC: High confidence, lower growth expectations

This positions ETH as the “goldilocks” crypto - substantial upside with reasonable confidence.

The Smart Contract Moat

Models implicitly recognize Ethereum’s competitive advantages:

- First-mover advantage in smart contracts

- Network effects from developers and users

- Lindy effect - survival increasing future survival odds

- Brand recognition as “the” smart contract platform

- Institutional comfort from longevity and size

What’s Next: Tracking the Thesis

We’ll continue monitoring Ethereum through our AI model surveys, focusing on:

- Adoption metrics for institutional and retail users

- Technical milestone achievement on the roadmap

- Regulatory developments globally

- Competitive dynamics with other L1s

- DeFi/NFT growth as use case validation

Follow our live ETH AI analysis page for real-time updates.

Final Thoughts: The Platform Play

The AI models’ strong consensus on Ethereum reflects its evolution from experimental technology to critical infrastructure. Unlike Bitcoin’s digital gold narrative or XRP’s payment focus, Ethereum represents a platform play - betting on an entire ecosystem rather than a single use case.

The 180-300% five-year projections aren’t just about price appreciation; they reflect expectations of Ethereum becoming the settlement layer for digital value. From DeFi protocols managing billions to NFTs redefining ownership, from corporate blockchain experiments to potential CBDC infrastructure, Ethereum sits at the center of multiple technological shifts.

Most tellingly, the models show higher confidence in ETH than in pure speculation plays while maintaining realistic growth expectations below meme coin moonshots. This balanced perspective - ambitious yet grounded - may explain why Ethereum continues to attract both innovators and institutions.

For investors, the AI consensus suggests Ethereum represents a core crypto allocation rather than a speculative punt. The combination of staking yields, deflationary mechanics, and ecosystem growth creates multiple paths to value creation beyond simple price appreciation.

Important Disclaimer: This analysis aggregates AI model opinions and should not be considered investment advice. Cryptocurrency investments carry significant risk, including potential total loss. Always conduct your own research and consult with qualified financial advisors.

Have questions about our AI analysis methodology? Contact our research team at info@hallucinationyield.com

Research Disclaimer

This article is for research and educational purposes only. Nothing in this content constitutes financial advice. All data and analysis should be used for research purposes only. We make no warranties about the accuracy or reliability of the information provided. Use at your own risk.