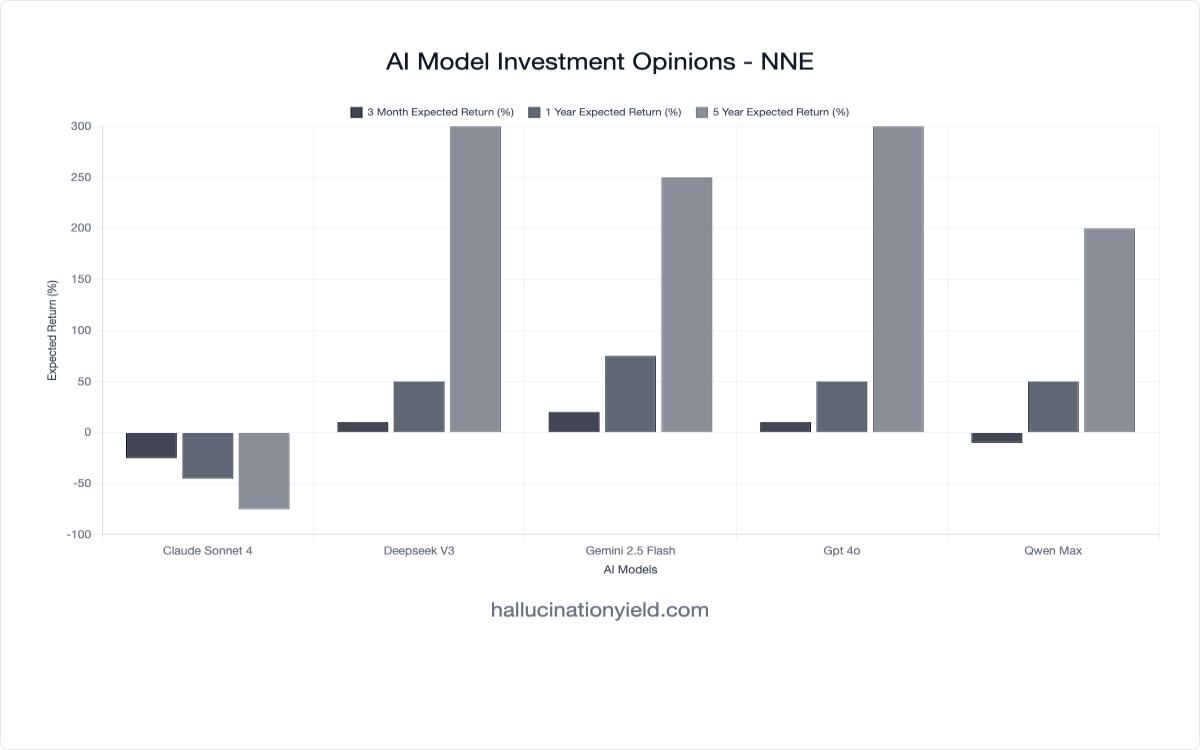

Nano Nuclear Energy (NNE): AI Models Split on Micro-Reactor Pioneer - From -75% to +300% Five-Year Projections

AI models show extreme divergence on Nano Nuclear Energy's prospects, with projections ranging from -75% to +300% over five years, highlighting the speculative nature and massive potential of small modular reactor technology.

import { Tweet } from ‘astro-embed’;

Our latest survey of leading AI models reveals unprecedented disagreement on Nano Nuclear Energy’s future, with projections spanning an extraordinary 375 percentage point range from -75% to +300% over five years. The analysis, conducted on July 27, 2025, exposes the fundamental uncertainty surrounding pre-revenue nuclear startups while highlighting the massive potential of small modular reactor technology.

Executive Summary: The Nuclear Divide

In stark contrast to the unified bullishness seen with assets like Ethereum, AI models show dramatic polarization on NNE’s prospects. The split centers on a critical question: Is NNE a transformative energy technology or a speculative bubble? Confidence levels range from an ultra-conservative 0.25 to a more assertive 0.65, reflecting the inherent uncertainty in pre-commercial nuclear ventures.

AI Model Predictions: Maximum Divergence

Here’s how the five leading AI models view NNE’s potential:

| AI Model | 3-Month Return | 1-Year Return | 5-Year Return | Bullishness (0-100) | Confidence |

|---|---|---|---|---|---|

| Claude Sonnet 4 | -25% | -45% | -75% | 15 | 0.25 |

| Qwen Max | -10% | +50% | +200% | 65 | 0.60 |

| DeepSeek v3 | +10% | +50% | +300% | 65 | 0.60 |

| GPT-4o | +10% | +50% | +300% | 70 | 0.60 |

| Gemini 2.5 Flash | +20% | +75% | +250% | 70 | 0.65 |

Model Averages:

- 3-Month: +1%

- 1-Year: +36%

- 5-Year: +195%

Divergence Metrics:

- 5-Year Range: 375 percentage points (-75% to +300%)

- Bullishness Range: 55 points (15 to 70)

- Confidence Range: 0.40 points (0.25 to 0.65)

Individual Model Analysis: The Great Nuclear Debate

Claude Sonnet 4 - The Nuclear Skeptic

“Pre-revenue nuclear startup with massive regulatory hurdles, dilutive financing needs, and speculative micro-reactor technology facing years of development risk.”

The Bear Case:

- Pre-revenue reality: No commercial income stream

- Regulatory maze: Nuclear approvals take years/decades

- Capital intensity: Massive dilution from funding needs

- Technology risk: Unproven micro-reactor concepts

- Competition: Established nuclear giants with deeper pockets

Claude’s -75% five-year projection and 15% bullishness score represent the most pessimistic view in our database, reflecting deep skepticism about speculative nuclear plays.

GPT-4o and DeepSeek v3 - The 300% Optimists

GPT-4o:

“Innovative technology in a growing sector with potential for significant market adoption.”

DeepSeek v3:

“High growth potential in nuclear energy sector but volatile short-term due to speculative nature.”

Both models project 300% five-year returns, emphasizing:

- Sector momentum: Growing nuclear renaissance

- Innovation premium: First-mover advantage in micro-reactors

- Market opportunity: Massive addressable market

- Technology disruption: Potential to transform energy

Gemini 2.5 Flash - The Strategic Bull

“NNE is a speculative bet on a nascent but critical energy technology with significant long-term growth potential, despite near-term volatility.”

Gemini’s analysis captures the investment thesis perfectly:

- Critical technology: Small modular reactors filling energy gap

- Long-term vision: Beyond current volatility

- Strategic positioning: Early in transformative cycle

- Risk acknowledgment: Speculative nature explicit

Qwen Max - The Measured Optimist

“Speculative nuclear energy play with long-term potential but near-term volatility and execution risk.”

Qwen takes a balanced approach:

- Long-term potential: Acknowledges sector opportunity

- Execution risk: Emphasizes implementation challenges

- Volatility warning: Realistic about price swings

- Measured optimism: 200% vs others’ 300%

The Confidence Paradox: Ultra-Low to Moderately High

The confidence scores tell their own story:

Claude’s Ultra-Conservative 0.25

- Maximum uncertainty about business model viability

- Regulatory risk dominating analysis

- Technology skepticism about commercial viability

- Financial concerns about funding pathway

Majority Cluster at 0.60-0.65

- Sector acknowledgment of nuclear energy importance

- Technology belief in small modular reactors

- Timing uncertainty about commercial deployment

- Balanced risk assessment of potential vs. challenges

Key Themes: The Nuclear Investment Thesis

1. The Small Modular Reactor Revolution

Every bullish model references the transformative potential of SMR technology:

- Smaller footprint: Easier permitting and deployment

- Modular design: Factory production advantages

- Passive safety: Enhanced safety systems

- Grid flexibility: Better integration with renewables

2. Energy Security and Climate Convergence

Nuclear energy sits at the intersection of multiple mega-trends:

- Climate targets: Carbon-free baseload power

- Energy security: Reduced fossil fuel dependence

- Grid stability: Reliable power as renewables scale

- Data center demand: AI driving massive power needs

3. Regulatory Pathway Challenges

The regulatory environment emerges as the key battleground:

- NRC approval process: Years of testing and validation

- Safety standards: Unprecedented scrutiny for new designs

- Public acceptance: Community engagement requirements

- International markets: Multiple regulatory frameworks

4. Capital Requirements vs. Market Opportunity

Models wrestle with the capital intensity paradox:

- Massive funding needs: Hundreds of millions for deployment

- Dilution risk: Equity raises at uncertain valuations

- Long development cycles: Years before revenue

- Enormous market: Trillions in energy infrastructure

The Pre-Revenue Challenge: Betting on the Future

NNE represents a pure technology bet unlike established energy companies:

Development Stage Risks

- Prototype to commercial: Major engineering challenges

- Manufacturing scale: Unproven production capabilities

- Supply chain: Building new nuclear supply networks

- Talent acquisition: Competing for scarce nuclear engineers

Financial Runway Concerns

- Burn rate: High monthly operational costs

- Funding milestones: Investor confidence dependent on progress

- Market conditions: Capital availability varying dramatically

- Valuation volatility: Stock price reflecting sentiment swings

Nuclear Renaissance or Nuclear Winter?

The AI models implicitly debate the nuclear sector’s trajectory:

Renaissance Indicators

- Big Tech investments: Microsoft, Google backing nuclear

- Government support: Bipartisan political backing

- Climate urgency: Growing recognition of nuclear necessity

- SMR momentum: Multiple companies pursuing similar tech

Winter Warnings

- Historical failures: Nuclear industry’s track record

- Cost overruns: Traditional nuclear projects struggling

- Public opposition: Persistent safety concerns

- Competitive alternatives: Renewable + storage advancing

Micro-Reactors: The Technology Bet

NNE’s core technology represents a fundamental shift:

Technical Advantages

- Transportable design: Truck or aircraft delivery

- Remote applications: Off-grid and military uses

- Rapid deployment: Reduced construction time

- Enhanced safety: Walk-away safe designs

Development Challenges

- Unproven at scale: Limited operational experience

- Manufacturing complexity: Nuclear-grade quality requirements

- Maintenance models: Remote servicing capabilities

- Fuel cycle: Simplified but unproven logistics

Market Opportunity: Sizing the Prize

The addressable market justifies optimistic projections:

Global Power Demand

- Data centers: AI boom driving exponential growth

- Electric vehicles: Transportation electrification

- Industrial decarbonization: Steel, cement, chemicals

- Developing markets: Billions needing clean baseload

Niche Markets

- Remote mining: Off-grid industrial applications

- Military bases: Energy security for defense

- Disaster response: Emergency power capabilities

- Space applications: Future lunar/Mars power

Risk Factors: What Could Derail the Thesis?

Despite bullish scenarios, models acknowledge severe risks:

Technology Risks

- Performance gaps: Reality vs. theoretical capabilities

- Safety incidents: Any nuclear accident affecting sector

- Cost overruns: Development expenses exceeding projections

- Competitive technology: Better alternatives emerging

Regulatory Hurdles

- Approval delays: NRC process taking longer than expected

- Changing standards: Evolving safety requirements

- International barriers: Export restrictions limiting markets

- Local opposition: Community resistance to deployment

Financial Challenges

- Funding shortfalls: Capital markets closing during downturns

- Dilution spiral: Successive equity raises at lower prices

- Cash burn: Operating costs outpacing development milestones

- Market conditions: Risk-off sentiment affecting speculative stocks

Competitive Threats

- Established players: GE, Westinghouse with superior resources

- Alternative technologies: Fusion, advanced renewables

- Cost competition: Solar/wind/storage becoming cheaper

- Industry consolidation: Smaller players squeezed out

The Speculation Premium: Valuing the Unknown

NNE’s valuation reflects pure optionality:

Bull Case Scenarios

- First-mover advantage: Capturing early SMR market share

- Government contracts: Military and federal deployment

- International expansion: Exporting U.S. nuclear technology

- Platform effects: Recurring revenue from fuel/services

Bear Case Realities

- Development failure: Technology not achieving commercial viability

- Regulatory rejection: NRC denying approval

- Funding crisis: Unable to raise sufficient capital

- Market displacement: Better technologies making SMRs obsolete

Investment Implications: High-Risk, High-Reward

The AI consensus suggests portfolio positioning considerations:

For Risk-Tolerant Investors

- Small position sizing: Limit exposure to 1-2% of portfolio

- Long time horizon: Expecting years of volatility

- Thesis monitoring: Tracking development milestones

- Exit planning: Clear criteria for success/failure

For Conservative Investors

- Avoid entirely: Stick to proven energy investments

- Sector exposure: Consider diversified clean energy ETFs

- Wait for validation: Enter after regulatory approvals

- Established alternatives: Focus on proven nuclear companies

Comparing Nuclear Bets: NNE vs. Established Players

The speculation premium becomes clear versus traditional nuclear:

- NNE: Pure technology bet with massive upside/downside

- Uranium miners: Commodity exposure to nuclear fuel

- Utilities: Regulated returns from existing plants

- Engineering firms: Service revenues from nuclear projects

Model Divergence: What It Reveals

The extreme disagreement among AI models highlights:

- Fundamental uncertainty about pre-revenue technology companies

- Sector expertise gaps in specialized nuclear knowledge

- Risk tolerance differences in evaluation frameworks

- Time horizon variations between models

- Technology assessment challenges for breakthrough innovations

Catalyst Timeline: Key Milestones Ahead

Several events could validate or destroy the bull thesis:

Near-Term (6-12 months)

- NRC pre-application meetings: Regulatory pathway clarity

- Funding announcements: Capital availability signals

- Partnership developments: Strategic alliance formations

- Technology demonstrations: Prototype performance data

Medium-Term (1-3 years)

- Regulatory submissions: Formal NRC application process

- Manufacturing partnerships: Production capability development

- Customer agreements: Early deployment commitments

- Competitive responses: Established player reactions

Long-Term (3-5 years)

- Commercial deployment: First operational micro-reactors

- Market validation: Revenue generation and profitability

- Scaling evidence: Multiple unit deployments

- Industry transformation: SMR market maturation

The AI Consensus: Cautious Optimism vs. Extreme Skepticism

Despite the range, four of five models remain bullish:

Optimistic Consensus (4 models)

- Average 5-year return: +262%

- Technology belief: SMR revolution is coming

- Market opportunity: Massive addressable market

- Risk acknowledgment: High volatility expected

Pessimistic Outlier (Claude)

- -75% projection: Technology/business model skepticism

- Regulatory focus: Emphasizing approval challenges

- Financial concerns: Dilution and funding risks

- Historical perspective: Nuclear industry track record

Global Nuclear Policy: Tailwinds and Headwinds

The regulatory environment remains critically important:

Supportive Trends

- U.S. policy: Bipartisan nuclear support

- International cooperation: NATO nuclear energy initiatives

- Climate commitments: Net-zero targets requiring nuclear

- Technology neutrality: Level playing field for clean energy

Challenging Dynamics

- Public opinion: Persistent nuclear skepticism

- Waste concerns: Long-term storage challenges

- Proliferation risks: Security considerations

- Economic competition: Cheap natural gas and renewables

Financial Structure: Venture vs. Public Market Dynamics

NNE operates in hybrid investment environment:

Venture Capital Characteristics

- Development stage: Pre-revenue technology company

- Binary outcomes: Success or failure scenarios

- Long time horizons: Patient capital requirements

- High risk/reward: Extreme return distributions

Public Market Realities

- Daily liquidity: Frequent price discovery

- Quarterly reporting: Short-term performance pressure

- Retail participation: Momentum-driven trading

- Risk management: Portfolio allocation constraints

What’s Next: Tracking the Nuclear Revolution

We’ll continue monitoring NNE and nuclear sector developments:

- Regulatory milestones: NRC approval process progress

- Technology validation: Performance demonstration results

- Funding developments: Capital market access and terms

- Competitive dynamics: Industry consolidation trends

- Policy changes: Government support evolution

Follow our live NNE AI analysis page for real-time updates.

Final Thoughts: Betting on Energy’s Future

The dramatic AI model disagreement on Nano Nuclear Energy reflects the fundamental uncertainty inherent in transformative technology investments. This isn’t a mature company with predictable cash flows - it’s a bet on the future of energy.

The bull case is compelling: small modular reactors could revolutionize nuclear power, making it safer, cheaper, and more accessible. If NNE executes successfully, the rewards could be extraordinary. The 300% projections from optimistic models reflect this transformative potential.

The bear case is equally valid: nuclear technology is notoriously difficult, regulatory approval is uncertain, and funding requirements are massive. Claude’s -75% projection acknowledges these harsh realities that have claimed many nuclear startups.

For investors, NNE represents a pure speculation play on nuclear energy’s renaissance. The wide range of AI predictions - from catastrophic loss to tremendous gains - accurately captures the binary nature of this investment. Success could generate life-changing returns; failure could result in total loss.

The increasing global energy demand, driven by AI, electrification, and climate goals, creates a massive opportunity for clean baseload power. Whether NNE captures this opportunity or becomes another cautionary tale remains one of the most intriguing investment questions of the decade.

Most importantly, the AI models’ disagreement serves as a perfect risk warning: when leading AI systems can’t agree on a stock’s prospects, individual investors should proceed with extreme caution and appropriate position sizing.

Important Disclaimer: This analysis aggregates AI model opinions and should not be considered investment advice. Nano Nuclear Energy represents a highly speculative investment with potential for total loss. The extreme divergence in AI predictions reflects fundamental uncertainty about the company’s prospects. Always conduct your own research and consult with qualified financial advisors before making investment decisions.

Have questions about our AI analysis methodology? Contact our research team at info@hallucinationyield.com

Research Disclaimer

This article is for research and educational purposes only. Nothing in this content constitutes financial advice. All data and analysis should be used for research purposes only. We make no warranties about the accuracy or reliability of the information provided. Use at your own risk.