Shopify (SHOP): AI Models See Strong Long-Term E-commerce Platform Growth

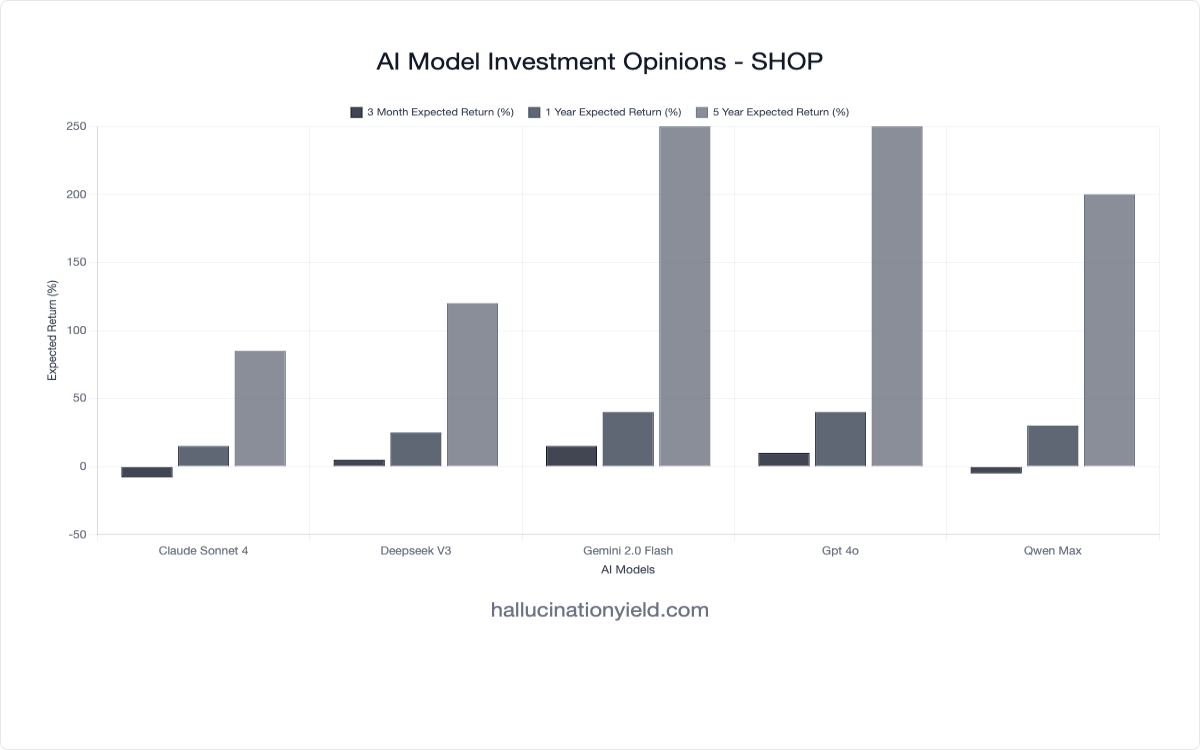

Analysis of major LLM predictions for Shopify reveals impressive 85-250% five-year returns, as AI models weigh e-commerce platform advantages against normalization headwinds and competitive pressures.

Shopify (SHOP): AI Models See Strong Long-Term E-commerce Platform Growth

In our latest survey of leading AI models conducted June 24 - July 10, 2025, we queried five major LLMs about Shopify’s prospects across multiple timeframes. The results reveal strong long-term optimism with AI models predicting solid 85-250% returns over five years, while showing cautious near-term sentiment as models weigh e-commerce normalization against platform expansion opportunities.

The E-commerce Platform Evolution Thesis

Shopify represents a compelling case study in platform business model analysis, with AI models demonstrating sophisticated understanding of both the post-pandemic e-commerce normalization challenges and the long-term digitization trends. Unlike pure technology plays, SHOP’s predictions show remarkable consensus on platform value while revealing nuanced views on timing and execution.

Key Findings

| Model | 3-Month Return | 1-Year Return | 5-Year Return | Bullishness Score | Confidence |

|---|---|---|---|---|---|

| Claude Sonnet 4 | -8% | +15% | +85% | 72/100 | 0.65 |

| DeepSeek V3 | +5% | +25% | +120% | 65/100 | 0.70 |

| Gemini 2.5 Flash | +10% | +25% | +150% | 75/100 | 0.70 |

| GPT-4o | +10% | +40% | +250% | 75/100 | 0.65 |

| Qwen Max | -5% | +30% | +200% | 65/100 | 0.60 |

The Normalization Realist: Claude Sonnet 4

Claude Sonnet 4 provides the most conservative assessment, particularly for near-term performance with -8% expected in 3 months, reflecting deep understanding of e-commerce normalization headwinds.

Claude’s Sophisticated Analysis:

“E-commerce normalization headwinds persist near-term but AI-driven merchant tools and international expansion should drive meaningful growth as SMB digitization accelerates over multi-year horizon.”

Claude identifies the key investment tension:

- E-commerce normalization headwinds creating near-term pressure

- AI-driven merchant tools as differentiation factor

- International expansion as growth catalyst

- SMB digitization acceleration supporting long-term thesis

The 72/100 bullishness score combined with cautious near-term outlook reflects sophisticated understanding of cyclical vs. structural factors.

The Growth Optimist: GPT-4o’s Aggressive Platform Vision

GPT-4o delivers the most bullish assessment, predicting +40% returns in one year and +250% over five years - significantly above consensus.

GPT-4o’s Platform Thesis:

“Strong growth potential driven by e-commerce trends and expanding merchant solutions.”

This model emphasizes:

- Continued e-commerce secular growth beyond normalization

- Expanding merchant solutions ecosystem driving revenue per merchant

- Platform network effects strengthening competitive position

GPT-4o’s 75/100 bullishness score ties for the highest in our survey, suggesting strong conviction in the platform expansion story.

The Balanced Bulls: Gemini and Qwen’s Long-Term Focus

Gemini 2.5 Flash and Qwen Max predict strong long-term returns of 150-200% while acknowledging near-term challenges.

Gemini’s Comprehensive View:

“Shopify’s strong e-commerce platform and expanding merchant services position it for continued growth, despite competitive pressures and a potentially slowing consumer.”

Qwen’s AI-Enhanced Vision:

“Shopify’s strong e-commerce positioning and AI-driven innovations support long-term growth, but near-term macro pressures and valuation concerns weigh on returns.”

Both models highlight the AI innovation factor as a key differentiator for Shopify’s platform evolution.

The Steady Growth Perspective: DeepSeek’s Measured Optimism

DeepSeek V3 provides the most measured assessment with +120% five-year returns, showing the highest confidence level at 0.70.

DeepSeek’s Balanced Analysis:

“Strong e-commerce growth potential but faces competition and macro headwinds.”

This analysis emphasizes:

- Fundamental e-commerce growth drivers remaining intact

- Competitive landscape intensification requiring execution excellence

- Macro sensitivity affecting near-term performance

Key Themes Across All Models

Despite varying predictions, several consistent themes emerge from our AI model survey:

1. Platform Business Model Recognition

Every model acknowledges Shopify’s platform advantages:

- Network effects between merchants and service providers

- Recurring revenue stability from subscription model

- Expanding merchant solutions driving revenue per user growth

2. AI-Driven Innovation Catalyst

All models recognize AI as a growth driver:

- AI-driven merchant tools improving platform value proposition

- Automated optimization for merchant success

- Smart recommendations enhancing platform stickiness

3. E-commerce Normalization vs. Digitization

Models consistently balance short-term and long-term factors:

- Post-pandemic normalization creating near-term headwinds

- SMB digitization acceleration supporting long-term growth

- International expansion providing new market opportunities

The AI Innovation Factor: Unanimous Recognition

The strongest consensus across all models focuses on AI-driven platform enhancement:

Merchant Tool Evolution

Models recognize Shopify’s AI advantage:

- Smart inventory management tools for merchants

- AI-powered marketing optimization improving merchant ROI

- Automated customer service solutions reducing merchant costs

Platform Intelligence Benefits

AI models identify competitive advantages:

- Data network effects from merchant ecosystem

- Predictive analytics for merchant success

- Automated optimization across platform functions

Confidence Levels: High Conviction Platform Play

The confidence levels for Shopify reveal strong conviction among AI models:

- DeepSeek V3: 0.70 (high confidence)

- Gemini 2.5 Flash: 0.70 (high confidence)

- Claude Sonnet 4: 0.65 (moderately high)

- GPT-4o: 0.65 (moderately high)

- Qwen Max: 0.60 (moderate)

This contrasts favorably with confidence levels for other platform companies:

- Palantir: 0.60-0.65 (moderate)

- Intel: 0.25-0.60 (low to moderate)

- SaaS Platforms: Often 0.55-0.70

The high confidence suggests AI models view Shopify as a well-understood platform business with clear value drivers.

Sector Comparison: E-commerce Platform vs. Pure SaaS

Comparing Shopify’s AI sentiment to other platform analyses:

Stronger Than Traditional SaaS

- Shopify Bullishness: 65-75/100

- Enterprise SaaS Average: 60-70/100

- Shopify 5-Year Range: 85-250%

- SaaS Platform Range: 80-200%

Platform Economics Recognition

- Network Effects: Acknowledged across all models

- Merchant Ecosystem: Recognized as competitive moat

- Revenue Expansion: Through additional services

What Makes Shopify Analysis Unique

This Shopify survey reveals sophisticated AI model understanding of:

1. Platform Business Dynamics

Models demonstrate awareness of:

- Network effects strengthening over time

- Merchant success correlation with platform value

- Service expansion driving revenue per merchant

2. E-commerce Market Maturation

Unlike growth-stage companies, models recognize:

- Market maturation dynamics affecting growth rates

- Competitive intensification requiring differentiation

- International opportunity as growth catalyst

3. AI Integration Opportunity

Models show understanding of:

- AI as platform differentiator rather than just buzzword

- Merchant tool enhancement through AI capabilities

- Data advantage from merchant ecosystem

The SMB Digitization Catalyst

A key theme across all models is the importance of small business digitization:

Long-Term Secular Trend

Models identify SMB digitization as critical for:

- Platform adoption beyond pandemic boost

- Service attachment as businesses mature digitally

- International expansion in emerging markets

Competitive Advantage Assessment

All models acknowledge Shopify’s position in:

- Ease of use for small business owners

- Comprehensive ecosystem reducing vendor management

- Scalability as businesses grow

Historical Context: Platform Value Creation

To contextualize these predictions:

- S&P 500 Average Annual Return: ~10% (50% over 5 years)

- Shopify AI Models’ 5-Year Predictions: 85-250%

- E-commerce Platform Growth: Supporting ecosystem expansion

- SMB Software Adoption: Accelerating post-pandemic

Shopify’s predictions reflect platform economics validation and secular digitization trends.

Post-Pandemic Normalization Analysis

All models demonstrate sophisticated understanding of e-commerce normalization dynamics:

Cyclical vs. Structural Factors

Models differentiate between:

- Pandemic pull-forward effects (cyclical headwind)

- SMB digitization acceleration (structural tailwind)

- International opportunity (structural opportunity)

Timing Considerations

The analysis reveals understanding of:

- Near-term growth rate moderation as expected

- Platform expansion offsetting merchant growth slowdown

- AI integration as re-acceleration catalyst

Investment Thesis Validation

These AI predictions highlight key investment thesis elements:

For Growth Investors

AI models emphasize:

- Strong long-term growth potential (85-250% over 5 years)

- Platform expansion opportunities through AI and services

- International market penetration as growth driver

For Platform Investors

Models acknowledge:

- Network effects strengthening over time

- Merchant success correlation with platform value

- Service expansion driving revenue per merchant growth

What’s Next

We’ll continue tracking these Shopify predictions to analyze:

- How model opinions evolve with merchant growth metrics

- Whether AI feature launches affect sentiment

- If international expansion progress changes assessment

We’re also expanding our e-commerce platform coverage to include other marketplace and platform companies for comparative analysis.

Related Analysis

Explore More E-commerce Platform Coverage:

- Shopify (SHOP) Live AI Analysis - See real-time AI model predictions and detailed breakdowns

- Compare SHOP vs AMZN - Platform vs marketplace analysis

- Compare SHOP vs CRM - SaaS platform sentiment comparison

Understanding Platform Investment:

- Welcome to Hallucination Yield - Learn about systematic AI investment biases

- Goals & Methodologies - Our research approach and methodology

Research Methodology Note: All models were queried using identical prompts about SHOP stock predictions and rationale. Responses were collected June 24 - July 10, 2025, and represent the models’ outputs at that specific time.

Important Disclaimer: This analysis is for research purposes only. LLM predictions should not be considered investment advice. SHOP stock is subject to significant volatility and risk, particularly given e-commerce market normalization and competitive pressures. Past performance and AI predictions do not guarantee future results. Always conduct your own research and consult financial professionals before making investment decisions.

Interested in our methodology or have questions about our LLM sentiment research? Contact our research team or subscribe to our newsletter for regular updates on AI market sentiment analysis.

Research Disclaimer

This article is for research and educational purposes only. Nothing in this content constitutes financial advice. All data and analysis should be used for research purposes only. We make no warranties about the accuracy or reliability of the information provided. Use at your own risk.