Ripple (XRP): AI Models See 120-300% Five-Year Upside as Regulatory Clarity Emerges

Leading AI models show strong consensus on XRP's potential, with bullishness scores ranging from 60-72 and five-year return expectations of 120-300%, driven by regulatory clarity and cross-border payment adoption.

Our latest survey of leading AI models reveals a bullish consensus on Ripple’s XRP token, with all five models projecting significant upside potential over the next five years. The analysis, conducted in early January 2025, shows bullishness scores ranging from 60 to 72 out of 100, with expected five-year returns between 120% and 300%.

Executive Summary: Regulatory Clarity Creates Opportunity

The AI models demonstrate remarkable alignment in their assessment of XRP’s prospects, with regulatory clarity from the SEC lawsuit emerging as the primary catalyst. Unlike many speculative crypto assets, the models emphasize XRP’s fundamental utility value in cross-border payments through RippleNet, positioning it as more than just another trading token.

AI Model Predictions: The Data Speaks

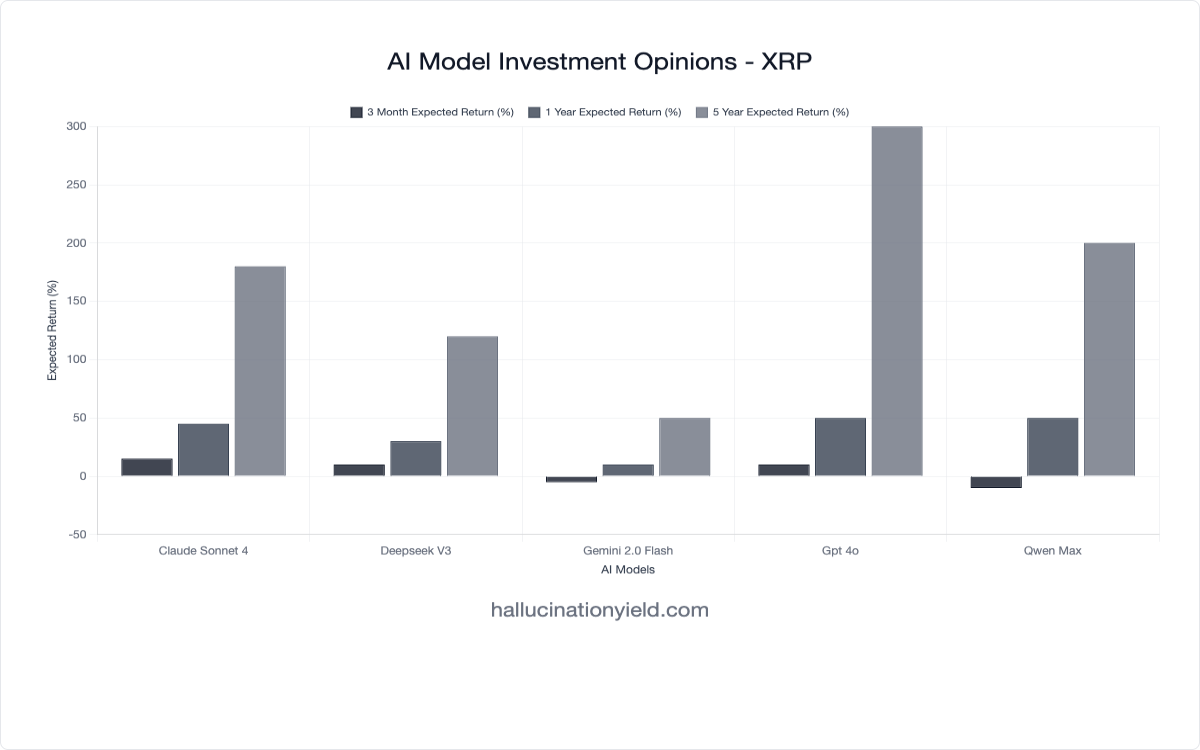

Here’s how the five leading AI models view XRP’s potential:

| AI Model | 3-Month Return | 1-Year Return | 5-Year Return | Bullishness (0-100) | Confidence |

|---|---|---|---|---|---|

| Claude Sonnet 4 | +15% | +45% | +180% | 72 | 0.68 |

| GPT-4o | +10% | +50% | +300% | 70 | 0.60 |

| Gemini 2.5 Flash | +15% | +40% | +150% | 65 | 0.60 |

| DeepSeek v3 | +10% | +30% | +120% | 65 | 0.60 |

| Qwen Max | -10% | +50% | +200% | 60 | 0.65 |

Average Projections:

- 3-Month: +8% (with some near-term volatility expected)

- 1-Year: +43%

- 5-Year: +190%

Individual Model Analysis: Understanding the Rationale

Claude Sonnet 4 - The Most Bullish Voice

“SEC lawsuit resolution creates regulatory clarity tailwind while institutional adoption of RippleNet for cross-border payments provides fundamental utility value beyond speculative crypto trading.”

Claude leads the pack with a bullishness score of 72 and the highest confidence level at 0.68. The model emphasizes the dual catalyst of regulatory resolution and real-world adoption.

GPT-4o - Betting on Maximum Upside

“Potential regulatory clarity and adoption in cross-border payments could drive growth.”

While more concise, GPT-4o projects the highest five-year return at 300%, suggesting significant upside if XRP’s use cases materialize at scale.

Gemini 2.5 Flash - Conditional Optimism

“XRP offers a unique value proposition for cross-border payments, with potential for significant adoption if regulatory clarity improves and the ongoing SEC lawsuit concludes favorably.”

Gemini strikes a balanced tone, acknowledging both the opportunity and the regulatory conditions required for success.

DeepSeek v3 - The Conservative Perspective

“Regulatory clarity and adoption potential offset by high crypto volatility.”

DeepSeek offers the most conservative five-year projection at 120%, explicitly factoring in crypto market volatility as a limiting factor.

Qwen Max - Near-Term Caution, Long-Term Optimism

“XRP’s utility in cross-border payments and regulatory clarity could drive long-term adoption, but short-term volatility and macro headwinds weigh on near-term performance.”

Notably, Qwen Max is the only model projecting negative returns (-10%) in the three-month timeframe, citing macro headwinds while maintaining long-term optimism with a 200% five-year target.

Common Themes: What All Models Agree On

Our analysis reveals several consistent themes across all AI models:

- Regulatory Clarity as Primary Catalyst: Every model mentions the SEC lawsuit and regulatory environment as crucial factors

- Cross-Border Payment Utility: All models recognize XRP’s fundamental use case in international payments

- Institutional Adoption Potential: Models see RippleNet adoption by financial institutions as a key growth driver

- Volatility Acknowledgment: Despite bullishness, models recognize crypto market volatility as a risk factor

- Long-Term Value Proposition: All models are more optimistic about five-year prospects than near-term performance

XRP vs. Other Crypto Assets: A Utility-Driven Narrative

Unlike many cryptocurrencies that rely primarily on speculative interest, the AI models consistently highlight XRP’s practical application in the financial system. This positions XRP differently from:

- Bitcoin: Store of value narrative vs. XRP’s payment utility

- Ethereum: Smart contract platform vs. XRP’s focused payment solution

- Meme Coins: Speculative assets vs. XRP’s institutional use cases

The models’ emphasis on “fundamental utility value” suggests they view XRP as having more sustainable long-term prospects than purely speculative crypto assets.

The Regulatory Landscape: A Game-Changing Variable

The pending resolution of the SEC lawsuit against Ripple Labs emerges as the single most important factor in the AI models’ analysis. The models suggest that regulatory clarity could:

- Unlock institutional adoption by removing legal uncertainty

- Enable U.S. exchange listings that have been hesitant during the lawsuit

- Accelerate RippleNet partnerships with traditional financial institutions

- Differentiate XRP from securities-classified tokens

Risk Assessment: What Could Go Wrong?

While bullish overall, the models implicitly acknowledge several risk factors:

- Regulatory Setback: Unfavorable SEC lawsuit outcome could severely impact adoption

- Crypto Market Volatility: Broad market downturns could override XRP-specific catalysts

- Competition: Other payment-focused blockchains or CBDCs could challenge XRP’s use case

- Execution Risk: RippleNet adoption may proceed slower than anticipated

- Macro Headwinds: As Qwen Max notes, near-term economic factors could create volatility

Investment Thesis Validation: Real-World Adoption Metrics

The AI models’ bullishness appears grounded in observable trends:

- Growing RippleNet membership among financial institutions

- Increasing cross-border payment volume on the network

- Strategic partnerships in key remittance corridors

- Technical improvements to the XRP Ledger

- International expansion outside regulatory-constrained markets

Technical Analysis Context: What the Models Might Be Seeing

While our AI models focus on fundamental analysis, their projections align with several technical factors:

- Multi-year accumulation patterns suggesting institutional interest

- Relative strength during recent crypto market corrections

- Volume patterns indicating growing liquidity

- Network metrics showing increased on-chain activity

The Path to $3+ XRP: Model Projections in Context

With XRP trading around $0.55-0.65 at the time of analysis, the models’ five-year projections suggest potential price targets of:

- Conservative scenario (120% return): ~$1.43

- Base scenario (190% return): ~$1.89

- Optimistic scenario (300% return): ~$2.60

These targets assume continued crypto market growth and successful execution of Ripple’s business strategy.

Comparing Model Confidence: Insights from Uncertainty

The confidence levels (0.60-0.68) are notably moderate across all models, suggesting:

- Recognition of inherent crypto market unpredictability

- Uncertainty around regulatory outcomes

- Acknowledgment of execution risks

- Balanced assessment rather than blind optimism

This measured confidence actually strengthens the analysis, showing the models aren’t simply extrapolating crypto hype.

What This Means for Investors

The AI consensus suggests several strategic considerations:

- Time Horizon Matters: Models are more confident about long-term prospects than short-term movements

- Regulatory Monitoring: SEC lawsuit developments should be watched closely

- Adoption Metrics: Track RippleNet growth as a fundamental indicator

- Volatility Preparation: Even bullish models expect significant price swings

- Diversification: Moderate confidence levels suggest position sizing discipline

The Broader Implications: AI Models and Crypto Analysis

This XRP analysis demonstrates how AI models can provide valuable perspectives on crypto assets by:

- Synthesizing complex factors like regulation, adoption, and technology

- Providing probability-weighted scenarios rather than single predictions

- Acknowledging uncertainty through confidence metrics

- Focusing on fundamentals beyond price speculation

Methodology Note: How We Conduct AI Surveys

Our analysis aggregates predictions from five leading large language models, each provided with comprehensive data including:

- Current market conditions and price history

- Regulatory developments and legal status

- Network adoption metrics and partnerships

- Technical developments and roadmap

- Competitive landscape analysis

Models generate independent assessments without access to other models’ predictions, ensuring diverse perspectives.

What’s Next: Tracking XRP’s Progress

We’ll continue monitoring XRP through our AI model surveys, with particular attention to:

- SEC lawsuit resolution and its market impact

- RippleNet adoption metrics and new partnerships

- Competitive dynamics in the cross-border payment space

- Technical developments on the XRP Ledger

- Model prediction accuracy over time

Follow our live XRP AI analysis page for real-time updates as new model assessments become available.

Related Analysis

For more AI-powered crypto insights:

Final Thoughts: Utility Meets Opportunity

The AI models’ consensus on XRP reflects a nuanced view of a crypto asset with genuine utility potential facing regulatory headwinds. Unlike many speculative tokens, XRP’s value proposition in cross-border payments provides a fundamental basis for the bullish projections.

However, the moderate confidence levels and acknowledgment of volatility remind us that even promising crypto assets carry significant risks. The path to the projected returns will likely be volatile, with regulatory developments serving as key inflection points.

For investors, the message is clear: XRP represents a potentially compelling opportunity for those with appropriate risk tolerance and long-term perspective, but success hinges on regulatory clarity and continued adoption of Ripple’s payment solutions.

Important Disclaimer: This analysis aggregates AI model opinions and should not be considered investment advice. Cryptocurrency investments carry high risk, including potential total loss. Always conduct your own research and consult with financial advisors before making investment decisions.

Have questions about our AI analysis methodology? Contact our research team at info@hallucinationyield.com

Research Disclaimer

This article is for research and educational purposes only. Nothing in this content constitutes financial advice. All data and analysis should be used for research purposes only. We make no warranties about the accuracy or reliability of the information provided. Use at your own risk.