Avalanche (AVAX): AI Models Bullish on Layer-1 Blockchain with 180-300% Five-Year Upside

Analysis of major LLM predictions for Avalanche reveals strong optimism with 180-300% five-year returns, as AI models weigh subnet architecture advantages against competitive Layer-1 landscape challenges.

Avalanche (AVAX): AI Models Bullish on Layer-1 Blockchain with 180-300% Five-Year Upside

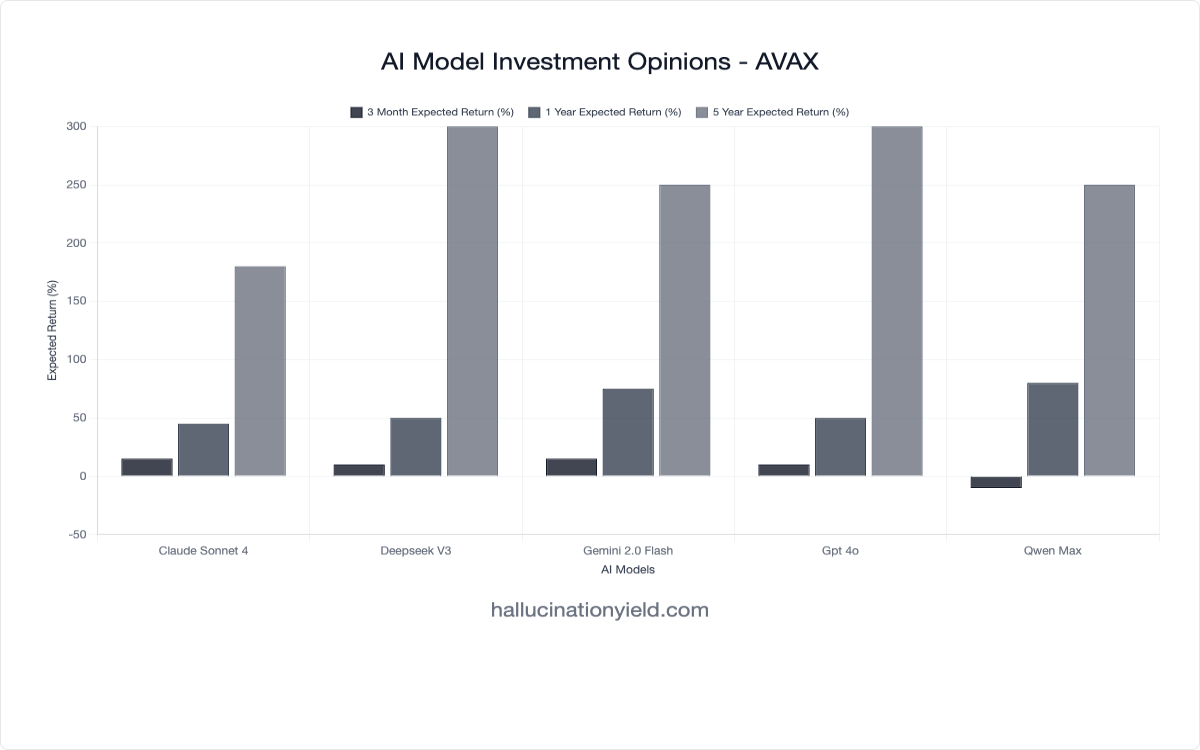

In our latest survey of leading AI models conducted July 4-10, 2025, we queried five major LLMs about Avalanche’s prospects across multiple timeframes. The results reveal exceptionally strong long-term optimism with AI models predicting impressive 180-300% returns over five years, while showing mixed near-term sentiment as models balance technological advantages against crypto market volatility.

The Subnet Innovation Thesis

Avalanche represents one of the most technically sophisticated Layer-1 blockchain platforms in our crypto analysis, with AI models demonstrating deep understanding of both the subnet architecture advantages and the competitive Layer-1 landscape challenges. Unlike Bitcoin or Ethereum analyses, AVAX predictions show remarkable consensus on technological superiority while revealing nuanced views on market timing and adoption.

Key Findings

| Model | 3-Month Return | 1-Year Return | 5-Year Return | Bullishness Score | Confidence |

|---|---|---|---|---|---|

| Claude Sonnet 4 | +15% | +45% | +180% | 72/100 | 0.65 |

| DeepSeek V3 | +10% | +50% | +300% | 65/100 | 0.60 |

| Gemini 2.5 Flash | +20% | +75% | +250% | 70/100 | 0.65 |

| GPT-4o | +10% | +50% | +300% | 70/100 | 0.60 |

| Qwen Max | -10% | +80% | +250% | 65/100 | 0.60 |

The Technology Bull: Claude Sonnet 4’s Architectural Focus

Claude Sonnet 4 provides the most technically nuanced assessment, showing strong conviction in Avalanche’s subnet architecture while acknowledging competitive pressures.

Claude’s Technical Analysis:

“Strong subnet architecture and institutional adoption potential offset by competitive L1 landscape and regulatory headwinds.”

Claude identifies the key technological differentiators:

- Subnet architecture enabling custom blockchain deployment

- Institutional adoption potential through enterprise-grade solutions

- Competitive L1 landscape creating execution challenges

- Regulatory headwinds affecting broader crypto adoption

The 72/100 bullishness score is the highest in our survey, reflecting strong conviction in Avalanche’s technical foundation.

The Ecosystem Optimists: DeepSeek and GPT-4o’s Growth Vision

DeepSeek V3 and GPT-4o both predict aggressive 300% five-year returns, emphasizing ecosystem development and DeFi adoption.

DeepSeek’s Growth Thesis:

“AVAX’s strong tech and ecosystem growth potential outweigh near-term crypto volatility.”

GPT-4o’s DeFi Focus:

“Strong ecosystem growth and increasing adoption in DeFi and NFTs.”

Both models emphasize:

- Strong technological foundation supporting long-term value

- Ecosystem expansion in DeFi and NFT sectors

- Adoption acceleration despite short-term volatility

The Aggressive Bull: Qwen Max’s Contrarian Outlook

Qwen Max delivers the most contrarian assessment, predicting -10% in 3 months but +80% in one year - the highest one-year prediction in our survey.

Qwen’s Strategic Timing:

“Avalanche’s strong tech fundamentals and ecosystem growth are balanced by near-term macro headwinds and market volatility.”

This analysis suggests:

- Near-term macro sensitivity affecting crypto prices

- Strong fundamental value supporting recovery

- Strategic buying opportunity in short-term weakness

The Market Realist: Gemini’s Balanced Optimism

Gemini 2.5 Flash provides the most optimistic near-term outlook with +20% in 3 months and +75% in one year.

Gemini’s Market Context:

“AVAX offers strong technicals and a growing ecosystem, positioning it for significant upside in a recovering crypto market, despite inherent volatility.”

Gemini emphasizes:

- Strong technical indicators supporting near-term performance

- Growing ecosystem development attracting users and capital

- Crypto market recovery benefiting quality Layer-1 platforms

Key Themes Across All Models

Despite varying predictions, several consistent themes emerge from our AI model survey:

1. Technology Leadership Recognition

Every model acknowledges Avalanche’s technical advantages:

- Subnet architecture enabling custom blockchain solutions

- High throughput and low latency compared to competitors

- Consensus mechanism innovation through Avalanche protocol

2. Ecosystem Development Catalyst

All models recognize ecosystem growth as a key driver:

- DeFi protocol adoption on Avalanche network

- NFT marketplace development attracting creators and traders

- Enterprise blockchain solutions through subnet customization

3. Competitive Layer-1 Landscape

Models consistently acknowledge the competitive environment:

- Ethereum’s continued dominance in smart contracts

- Solana’s performance competition in high-throughput space

- Regulatory uncertainty affecting all Layer-1 platforms

The DeFi Ecosystem Factor: Unanimous Growth Driver

The strongest consensus across all models focuses on DeFi ecosystem expansion:

Protocol Adoption Advantages

Models recognize Avalanche’s DeFi positioning:

- Low transaction costs attracting DeFi protocols

- Fast finality improving user experience

- Ethereum Virtual Machine compatibility easing migration

Total Value Locked Growth

AI models identify competitive advantages:

- Growing TVL across DeFi protocols

- Yield farming opportunities attracting liquidity

- Cross-chain bridge development expanding ecosystem reach

Confidence Levels: Moderate Conviction with Technology Focus

The confidence levels for Avalanche reveal moderate conviction among AI models:

- Claude Sonnet 4: 0.65 (moderately high)

- Gemini 2.5 Flash: 0.65 (moderately high)

- All Others: 0.60 (moderate)

This compares favorably with other crypto analyses:

- Bitcoin: 0.60-0.75 (moderate to high)

- Ethereum: 0.65-0.70 (moderately high)

- Solana: 0.55-0.65 (moderate)

The moderate-to-high confidence suggests AI models view Avalanche as a well-understood Layer-1 with clear technological advantages.

Sector Comparison: Layer-1 Competition Analysis

Comparing Avalanche’s AI sentiment to other blockchain platforms:

Stronger Than Emerging L1s

- Avalanche Bullishness: 65-72/100

- Average L1 Bullishness: 55-65/100

- Avalanche 5-Year Range: 180-300%

- Emerging L1 Range: 100-250%

Technology Differentiation Recognition

- Subnet Architecture: Unique competitive advantage

- Institutional Focus: Enterprise blockchain solutions

- DeFi Ecosystem: Growing total value locked

What Makes Avalanche Analysis Unique

This Avalanche survey reveals sophisticated AI model understanding of:

1. Blockchain Technology Architecture

Models demonstrate awareness of:

- Consensus mechanism innovation through Avalanche protocol

- Subnet customization capabilities for enterprise use cases

- Interoperability features with other blockchain networks

2. Layer-1 Competitive Dynamics

Unlike application-layer projects, models recognize:

- Network effects in blockchain adoption

- Developer ecosystem importance for long-term success

- Institutional adoption requirements for enterprise blockchain

3. Crypto Market Cycle Sensitivity

Models show understanding of:

- Macro correlation with broader crypto markets

- Technology adoption curves in blockchain space

- Regulatory impact on Layer-1 platform development

The Enterprise Blockchain Catalyst

A key theme across all models is the importance of enterprise and institutional adoption:

Subnet Architecture Advantage

Models identify enterprise appeal of:

- Custom blockchain deployment for specific use cases

- Regulatory compliance capabilities through permissioned subnets

- Scalability solutions for high-throughput applications

Institutional Adoption Drivers

All models acknowledge Avalanche’s positioning for:

- Central bank digital currency (CBDC) pilots

- Enterprise DeFi applications

- Supply chain tracking through custom subnets

Historical Context: Layer-1 Value Creation

To contextualize these predictions:

- Major Crypto Average Returns: Highly volatile, 100-500% ranges common

- Avalanche AI Models’ 5-Year Predictions: 180-300%

- Layer-1 Platform Competition: Intense with clear technical differentiation

- DeFi Market Growth: Supporting ecosystem expansion

Avalanche’s predictions reflect technological differentiation recognition and ecosystem growth potential.

Regulatory and Market Risk Assessment

All models demonstrate awareness of crypto-specific risk factors:

Regulatory Environment

Models acknowledge challenges including:

- SEC classification uncertainty for crypto tokens

- International regulatory coordination affecting adoption

- Staking reward taxation impacting token economics

Market Volatility Factors

The analysis reveals understanding of:

- Crypto market correlation with risk assets

- Liquidity dynamics in smaller Layer-1 tokens

- Technology adoption curves affecting valuation timing

Investment Thesis Validation

These AI predictions highlight key investment thesis elements:

For Crypto Investors

AI models emphasize:

- Strong technological foundation (180-300% five-year potential)

- Ecosystem growth momentum in DeFi and enterprise

- Competitive differentiation through subnet architecture

For Technology Investors

Models acknowledge:

- Innovation leadership in consensus mechanisms

- Enterprise adoption potential through custom solutions

- Developer ecosystem growth supporting long-term value

What’s Next

We’ll continue tracking these Avalanche predictions to analyze:

- How model opinions evolve with subnet deployment announcements

- Whether DeFi protocol launches affect sentiment

- If enterprise partnerships change institutional adoption assessment

We’re also expanding our Layer-1 blockchain coverage to include other smart contract platforms for comparative analysis.

Related Analysis

Explore More Crypto Analysis:

- Avalanche (AVAX) Live AI Analysis - See real-time AI model predictions and detailed breakdowns

- Compare ETH vs AVAX - Ethereum vs Avalanche sentiment comparison

- Compare SOL vs AVAX - Solana vs Avalanche Layer-1 competition

- Bitcoin AI Consensus Analysis - Crypto market leader comparison

Understanding Crypto Investment:

- Welcome to Hallucination Yield - Learn about systematic AI investment biases

- Goals & Methodologies - Our research approach and methodology

Research Methodology Note: All models were queried using identical prompts about AVAX predictions and rationale. Responses were collected July 4-10, 2025, and represent the models’ outputs at that specific time.

Important Disclaimer: This analysis is for research purposes only. LLM predictions should not be considered investment advice. AVAX and cryptocurrency investments are subject to extreme volatility and risk, including total loss of capital. Regulatory changes could significantly impact crypto asset values. Past performance and AI predictions do not guarantee future results. Always conduct your own research and consult financial professionals before making investment decisions.

Interested in our methodology or have questions about our LLM sentiment research? Contact our research team or subscribe to our newsletter for regular updates on AI market sentiment analysis.

Research Disclaimer

This article is for research and educational purposes only. Nothing in this content constitutes financial advice. All data and analysis should be used for research purposes only. We make no warranties about the accuracy or reliability of the information provided. Use at your own risk.