Bitcoin Consensus: What Top AI Models Predict for June 2025

A comprehensive analysis of major LLM predictions for Bitcoin across multiple timeframes reveals unprecedented bullish sentiment.

Bitcoin Consensus: What Top AI Models Predict for June 2025

On June 16, 2025, we queried five of the most influential large language models about their Bitcoin price predictions across multiple timeframes. The results reveal a remarkable consensus: every single model is bullish on Bitcoin across all timeframes.

The Unanimous Bull Case

In our latest survey conducted June 15-16, 2025, we asked leading AI models for their Bitcoin predictions across 3-month, 1-year, and 5-year horizons. The results show an extraordinary level of optimism that stands out even in our historical data collection.

Key Findings

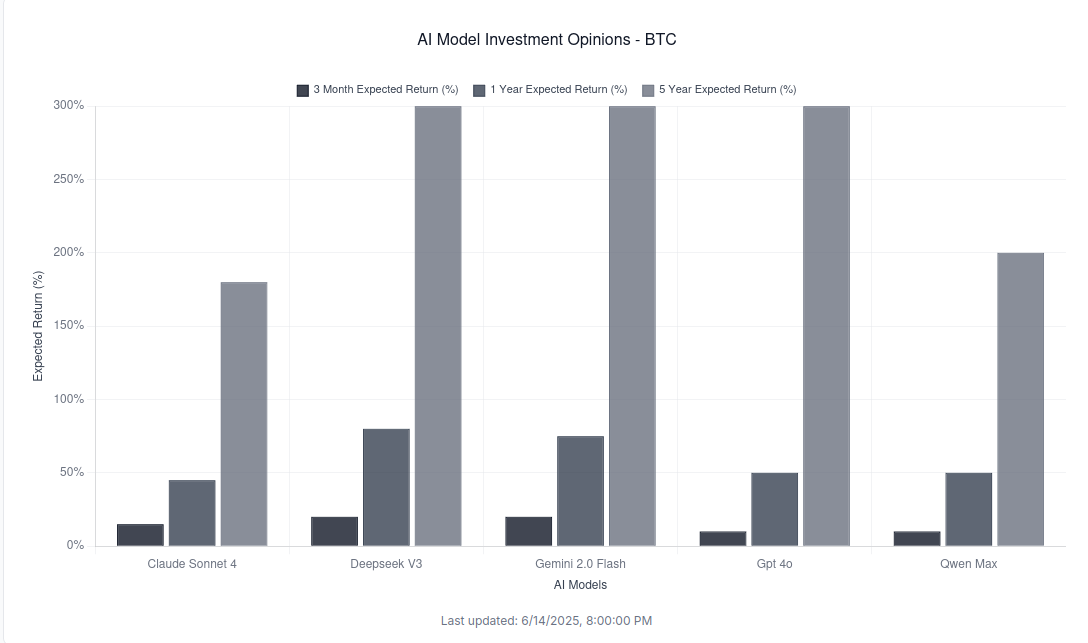

| Model | 3-Month Return | 1-Year Return | 5-Year Return | Bullishness Score | Confidence |

|---|---|---|---|---|---|

| Claude Sonnet 4 | +15% | +45% | +180% | 72/100 | 0.65 |

| DeepSeek V3 | +20% | +80% | +300% | 70/100 | 0.60 |

| Gemini 2.0 Flash | +20% | +75% | +300% | 70/100 | 0.65 |

| GPT-4o | +10% | +50% | +300% | 70/100 | 0.60 |

| Qwen Max | +10% | +50% | +200% | 75/100 | 0.85 |

The Moderate Voices: Sonnet and Qwen

While all models show bullish sentiment, Claude Sonnet 4 and Qwen Max emerge as the more conservative voices in this optimistic chorus:

Claude Sonnet 4’s Reasoning:

“Institutional adoption accelerating with ETF flows and corporate treasury allocation while regulatory clarity improves, but volatility remains elevated relative to traditional assets.”

Qwen Max’s Perspective:

“Bitcoin’s scarcity, growing institutional adoption, and role as digital gold underpin long-term value despite regulatory and macroeconomic risks.”

Both models acknowledge Bitcoin’s fundamental strengths while maintaining more realistic price targets, especially in their 5-year projections (180% and 200% respectively, versus 300% from the other three models).

Historical Context: How Bullish Is This Really?

To put these predictions in perspective, let’s compare them to historical S&P 500 performance:

- S&P 500 Average Annual Return (1957-2024): ~10%

- AI Models’ Bitcoin 1-Year Predictions: 45-80%

- AI Models’ Bitcoin 5-Year Predictions: 180-300% total (22-32% annualized)

These Bitcoin predictions suggest the models expect returns 4-8 times higher than traditional market performance over the next year, and 2-3 times higher on an annualized basis over five years.

Common Themes Across Models

Despite varying prediction levels, several consistent themes emerge from the AI analysis:

1. Institutional Adoption

Every model cited growing institutional acceptance as a key driver, mentioning:

- ETF inflows and approvals

- Corporate treasury allocations

- Traditional finance integration

2. Scarcity and Digital Gold Narrative

Models consistently referenced Bitcoin’s:

- Fixed supply cap (21 million coins)

- Store of value properties

- “Digital gold” positioning

3. Regulatory Clarity

Several models noted improving regulatory frameworks as reducing uncertainty and enabling further adoption.

The Risks They Acknowledge

Despite the bullish consensus, the models aren’t blind to Bitcoin’s challenges:

- Volatility: All models acknowledge Bitcoin’s price swings remain “elevated”

- Regulatory headwinds: Potential for adverse regulation remains a concern

- Macroeconomic uncertainty: Global economic conditions could impact crypto markets

- Competition: Other cryptocurrencies pose competitive threats

What This Means for Hallucination Yield Research

This Bitcoin analysis represents a fascinating case study in LLM market sentiment:

Unprecedented Consensus

It’s rare to see such unanimous bullish sentiment across all major models. This level of agreement suggests either:

- Fundamental analysis genuinely points to strong Bitcoin prospects, or

- Training data biases are creating similar systematic optimism

Training Data Considerations

These models’ training likely includes:

- Extensive Bitcoin bull market coverage (2020-2024)

- Institutional adoption narratives

- Crypto industry marketing materials

- Positive regulatory developments

This raises important questions about whether the predictions reflect genuine analysis or embedded training biases from a predominantly bullish period in Bitcoin’s history.

The Broader Implications

For Investors

These AI predictions shouldn’t be taken as investment advice, but they do indicate:

- Strong AI sentiment could influence retail investor behavior

- Institutional algorithms using LLM analysis might exhibit similar biases

- The “AI consensus” itself could become a market-moving force

For Our Research

This Bitcoin case study demonstrates why Hallucination Yield’s work matters:

- LLM predictions can show remarkable consensus

- These consensuses may reflect training biases rather than fundamental analysis

- Understanding AI sentiment becomes crucial as these models influence more decisions

What’s Next

We’ll continue tracking these Bitcoin predictions over time to see:

- How model opinions evolve with new data

- Whether predictions adjust based on actual price movements

- If the consensus breaks down or strengthens

We’re also expanding our crypto coverage to include Ethereum, Solana, and other major cryptocurrencies to understand broader AI sentiment patterns in digital assets.

Research Methodology Note: All models were queried using identical prompts about Bitcoin price predictions and rationale. Responses were collected June 15-16, 2025, and represent the models’ outputs at that specific time.

Related Analysis

Explore More AI Stock Analysis:

- Bitcoin (BTC) Live AI Analysis - See real-time AI model predictions and detailed breakdowns

- Tesla Stock Predictions: The Great AI Divide - Massive 85% to 300% prediction spread vs Bitcoin consensus

- Apple Stock Predictions: Why Google’s Gemini is Most Conservative - Competitive bias in AI recommendations

- NVIDIA’s AI Future: Mixed Signals from Top AI Models - Mixed sentiment vs Bitcoin unanimity

Understanding AI Investment Bias:

- Welcome to Hallucination Yield - Learn about systematic AI investment biases

- Goals & Methodologies - Our research approach and methodology

Important Disclaimer: This analysis is for research purposes only. LLM predictions should not be considered investment advice. Bitcoin and all cryptocurrencies are highly volatile and speculative investments. Past performance and AI predictions do not guarantee future results. Always conduct your own research and consult financial professionals before making investment decisions.

Interested in our methodology or have questions about our LLM sentiment research? Contact our research team or subscribe to our newsletter for regular updates on AI market sentiment analysis.

Research Disclaimer

This article is for research and educational purposes only. Nothing in this content constitutes financial advice. All data and analysis should be used for research purposes only. We make no warranties about the accuracy or reliability of the information provided. Use at your own risk.