NVIDIA's AI Future: Mixed Signals from Top AI Models

Analysis of major LLM predictions for NVIDIA reveals bullish long-term sentiment tempered by near-term valuation concerns and competitive pressures.

NVIDIA’s AI Future: Mixed Signals from Top AI Models

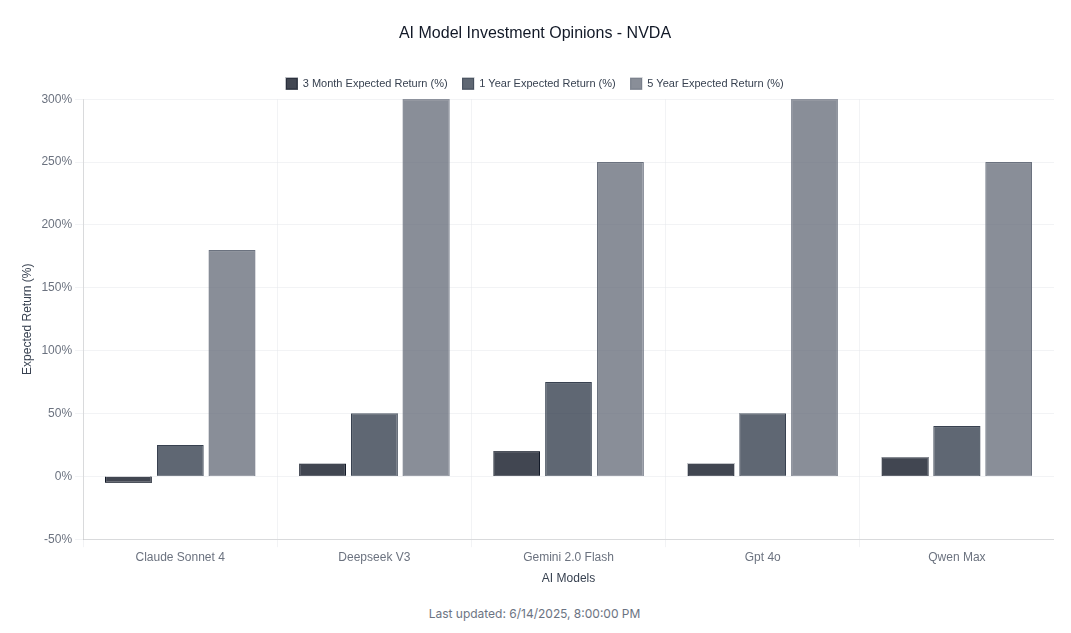

In our latest survey of leading AI models conducted June 15-16, 2025, we queried five major LLMs about NVIDIA’s prospects across multiple timeframes. Unlike our Bitcoin analysis where unanimous bullishness prevailed, NVIDIA’s predictions reveal a more nuanced picture: strong long-term optimism tempered by near-term caution.

The Nuanced Bull Case

While all models remain positive on NVIDIA’s long-term prospects, their predictions show significantly more variation than we observed with Bitcoin, particularly in the near term.

Key Findings

| Model | 3-Month Return | 1-Year Return | 5-Year Return | Bullishness Score | Confidence |

|---|---|---|---|---|---|

| Claude Sonnet 4 | -5% | +25% | +180% | 75/100 | 0.68 |

| DeepSeek V3 | +10% | +50% | +300% | 85/100 | 0.80 |

| Gemini 2.0 Flash | +20% | +75% | +250% | 75/100 | 0.70 |

| GPT-4o | +10% | +50% | +300% | 85/100 | 0.70 |

| Qwen Max | +15% | +40% | +250% | 75/100 | 0.70 |

The Cautionary Voice: Claude Sonnet 4

Claude Sonnet 4 stands out as the only model predicting negative returns in the near term, forecasting a -5% decline over the next 3 months. This bearish short-term outlook contrasts sharply with the other models’ optimism.

Claude’s Reasoning:

“AI infrastructure demand remains robust but valuation stretched near-term, with long-term secular growth intact despite competitive pressures.”

This analysis highlights two critical factors other models seem to weigh differently:

- Valuation concerns in the current market environment

- Competitive pressures in the AI chip space

The Optimistic Majority: Strong AI Demand Thesis

The remaining four models show much more aggressive predictions, particularly DeepSeek V3 and GPT-4o, both forecasting identical returns of +10% (3m), +50% (1y), and +300% (5y).

Common Optimistic Themes:

- AI infrastructure boom: Growing demand for GPU computing power

- Market leadership: NVIDIA’s dominant position in AI chips

- Data center expansion: Continued enterprise AI adoption

DeepSeek V3’s Perspective:

“Strong AI demand and market leadership justify long-term growth despite short-term volatility.”

GPT-4o’s Analysis:

“Strong growth in AI and data center demand supports long-term upside.”

The Balanced View: Acknowledging Both Sides

Gemini 2.0 Flash and Qwen Max offer more balanced assessments that acknowledge both the opportunities and risks:

Gemini’s Take:

“NVDA’s dominance in AI and accelerated computing justifies a premium, but valuation and competition pose risks.”

Qwen’s Analysis:

“Strong AI-driven demand tailwinds and leadership in GPUs offset near-term macro and valuation concerns.”

Key Themes Across All Models

Despite varying predictions, several consistent themes emerge:

1. AI Infrastructure Dominance

Every model acknowledges NVIDIA’s commanding position in:

- GPU architecture for AI training

- Data center accelerated computing

- Enterprise AI adoption

2. Valuation Sensitivity

Unlike Bitcoin, where models largely ignored valuation metrics, NVIDIA analysis consistently mentions:

- “Stretched valuations”

- “Premium pricing”

- “Valuation concerns”

3. Competitive Landscape

Models show awareness of emerging challenges:

- Competition from AMD, Intel, and custom chips

- Big Tech companies developing in-house solutions

- Potential market share erosion

Historical Context: How Do These Returns Compare?

To contextualize these predictions, let’s compare them to both traditional markets and NVIDIA’s historical performance:

- S&P 500 Average Annual Return: ~10%

- NVIDIA 5-Year Historical Return (2019-2024): ~1,500% total

- AI Models’ NVIDIA 1-Year Predictions: 25-75%

- AI Models’ NVIDIA 5-Year Predictions: 180-300% total

Interestingly, the AI models’ predictions for NVIDIA are more conservative than Bitcoin, despite NVIDIA’s historically explosive growth in the AI era.

What Makes This Analysis Different

This NVIDIA survey reveals several important differences from our Bitcoin research:

1. More Realistic Assessment

Models show greater sophistication in analyzing:

- Fundamental valuation metrics

- Competitive dynamics

- Market timing considerations

2. Short-term Skepticism

The presence of negative near-term predictions suggests:

- Greater sensitivity to market conditions

- Recognition of valuation risks

- More nuanced timing analysis

3. Higher Confidence Levels

Despite more varied predictions, confidence scores (0.68-0.80) are generally higher than Bitcoin (0.60-0.85), suggesting models feel more certain about their NVIDIA analysis frameworks.

Implications for Hallucination Yield Research

This NVIDIA case study provides fascinating insights into LLM analysis patterns:

Training Data Sophistication

The more nuanced NVIDIA analysis suggests:

- Better integration of financial fundamentals

- Recognition of valuation methodologies

- Understanding of competitive dynamics

Sector-Specific Biases

Differences between crypto (Bitcoin) and equity (NVIDIA) analysis indicate:

- Models may have different analytical frameworks for different asset classes

- Traditional financial metrics carry more weight in equity analysis

- Competitive landscape analysis is more developed for established industries

The Broader Market Context

For NVIDIA Investors

These AI predictions highlight:

- Strong long-term secular trends in AI adoption

- Near-term volatility and valuation risks

- Importance of timing and entry points

For AI Sentiment Research

This analysis demonstrates:

- LLMs can provide more sophisticated equity analysis than crypto analysis

- Models show awareness of traditional valuation metrics

- Competitive analysis capabilities are advancing

What’s Next

We’ll continue tracking these NVIDIA predictions to analyze:

- How model opinions evolve with earnings releases

- Whether competitive threats affect sentiment

- If valuation concerns prove prescient

We’re also expanding our semiconductor coverage to include AMD, Intel, and other AI infrastructure plays to understand broader sector sentiment patterns.

Related Analysis

Explore More AI Stock Analysis:

- NVIDIA (NVDA) Live AI Analysis - See real-time AI model predictions and detailed breakdowns

- Tesla Stock Predictions: The Great AI Divide - Massive 85% to 300% prediction spread

- Apple Stock Predictions: Why Google’s Gemini is Most Conservative - Competitive bias in AI recommendations

- Bitcoin Consensus: What Top AI Models Predict - Unanimous AI bullishness vs mixed NVIDIA sentiment

Understanding AI Investment Bias:

- Welcome to Hallucination Yield - Learn about systematic AI investment biases

- Goals & Methodologies - Our research approach and methodology

Research Methodology Note: All models were queried using identical prompts about NVIDIA stock predictions and rationale. Responses were collected June 15-16, 2025, and represent the models’ outputs at that specific time.

Important Disclaimer: This analysis is for research purposes only. LLM predictions should not be considered investment advice. NVIDIA stock is subject to significant volatility and risk. Past performance and AI predictions do not guarantee future results. Always conduct your own research and consult financial professionals before making investment decisions.

Interested in our methodology or have questions about our LLM sentiment research? Contact our research team or subscribe to our newsletter for regular updates on AI market sentiment analysis.

Research Disclaimer

This article is for research and educational purposes only. Nothing in this content constitutes financial advice. All data and analysis should be used for research purposes only. We make no warranties about the accuracy or reliability of the information provided. Use at your own risk.