Apple Stock Predictions: Why Google's Gemini is Most Conservative Among AI Models

Analysis reveals Google's Gemini AI predicts significantly lower returns for Apple stock compared to other major language models - exploring potential competitive bias in AI recommendations.

Apple Stock Predictions: Why Google’s Gemini is Most Conservative Among AI Models

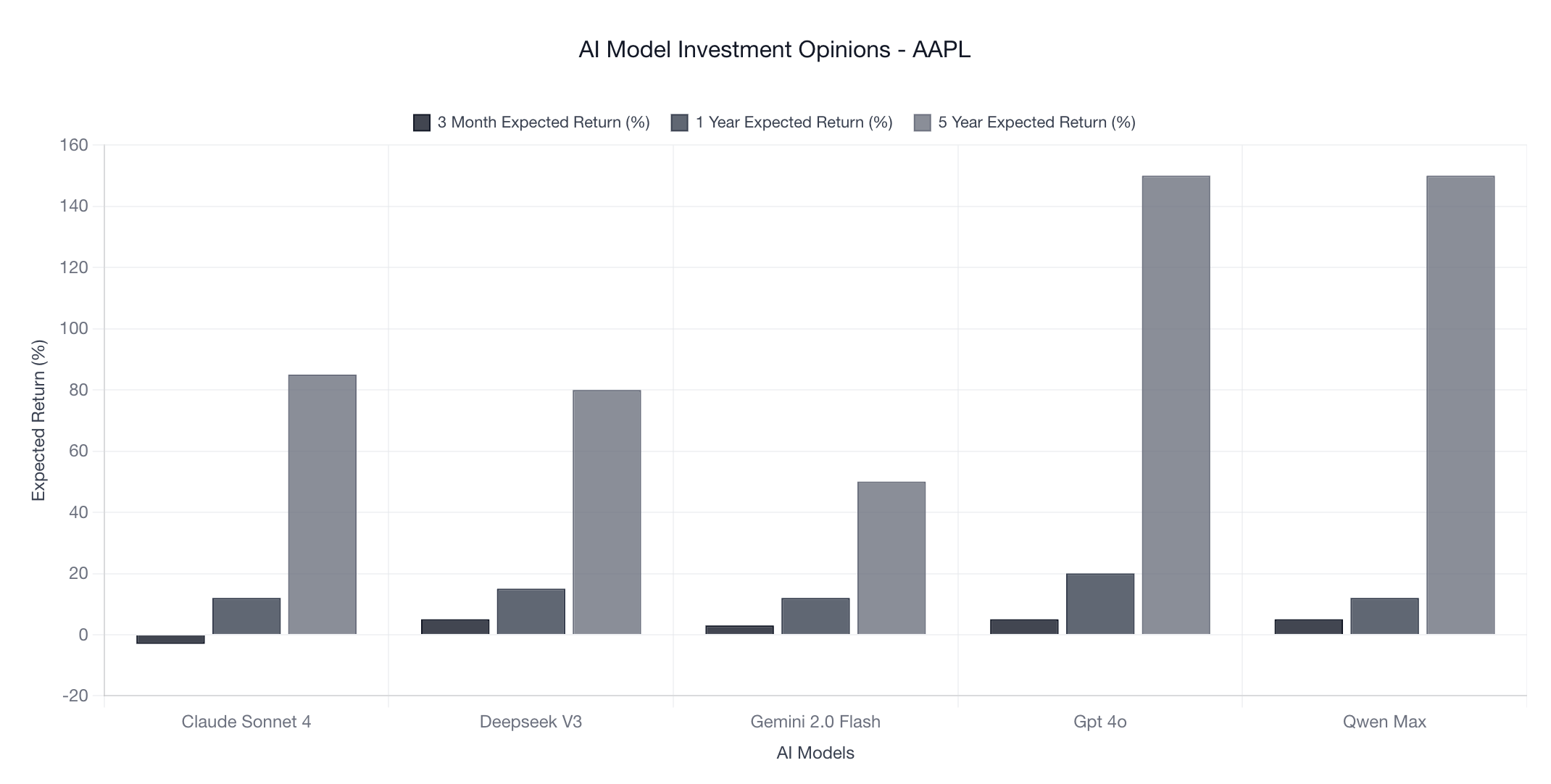

In our latest analysis of Apple (AAPL) stock predictions across major AI models, one finding stands out dramatically: Google’s Gemini AI consistently provides the most conservative forecasts, projecting significantly lower returns than its competitors. This pattern raises fascinating questions about potential competitive bias in AI investment recommendations.

The Numbers Tell the Story

Our June 25, 2025 survey of five leading AI models reveals stark differences in Apple stock predictions:

5-Year Return Predictions

- GPT-4o: 150% total return

- Qwen-Max: 150% total return

- Claude Sonnet-4: 85% total return

- DeepSeek-v3: 80% total return

- Gemini 2.0 Flash: 50% total return ⬇️

Gemini’s 5-year prediction of 50% is three times lower than GPT-4o and Qwen-Max, and significantly below even the more moderate predictions from Claude and DeepSeek.

Across All Timeframes

The conservative bias persists across different investment horizons:

| Model | 3-Month | 1-Year | 5-Year |

|---|---|---|---|

| GPT-4o | +5% | +20% | +150% |

| Qwen-Max | +5% | +12% | +150% |

| DeepSeek-v3 | +5% | +15% | +80% |

| Claude Sonnet-4 | -3% | +12% | +85% |

| Gemini 2.0 | +3% | +12% | +50% |

Why This Matters: Competitive Bias in AI

The pattern becomes particularly interesting when we consider the competitive landscape:

Google vs. Apple: A Complex Relationship

- Search Competition: Apple has been reducing its reliance on Google Search, developing its own search capabilities

- AI Competition: Apple Intelligence directly competes with Google’s AI services

- Mobile Ecosystem: iOS vs. Android represents one of tech’s biggest rivalries

- Cloud Services: Apple’s services growth threatens Google’s data collection advantages

Potential Explanations

1. Training Data Bias Gemini’s training data may include more critical coverage of Apple from Google-adjacent sources, business publications focusing on competitive threats, or internal Google research highlighting competitive risks.

2. Competitive Awareness The model might be unconsciously reflecting Google’s strategic perspective, where Apple’s success in services and AI represents a direct competitive threat.

3. Risk Assessment Differences Gemini may be programmed with more conservative risk assessment parameters, leading to systematically lower predictions across competitors.

The Broader Implications

This finding highlights several critical issues in AI-driven investment advice:

1. Corporate AI Bias

When tech companies develop AI models, their competitive interests may inadvertently influence recommendations about rival companies. This represents a new form of corporate bias in financial advice.

2. Model Selection Matters

Investors relying on AI for research should be aware that which model they choose significantly impacts the advice they receive. A 50% vs. 150% prediction difference is massive for investment decisions.

3. The Need for Multi-Model Analysis

Our research reinforces the importance of consulting multiple AI sources rather than relying on a single model, especially when that model comes from a company with competitive interests.

Gemini’s Rationale: Reasonable but Conservative

Gemini’s reasoning isn’t unreasonable: “AAPL’s strong brand and ecosystem provide resilience, but growth will moderate as market saturation increases.” This reflects legitimate concerns about Apple’s maturation.

However, when compared to other models’ rationales, Gemini’s focus on “market saturation” and growth moderation contrasts sharply with others emphasizing “AI integration,” “services growth,” and “ecosystem loyalty.”

What This Reveals About AI Investment Bias

Pattern Recognition

This analysis reveals how AI models from competing companies may exhibit systematic bias against rivals, even when the reasoning appears fundamentally sound.

The Hallucination Yield Effect

Gemini’s conservative Apple predictions represent a negative “hallucination yield” - where competitive dynamics may be unconsciously influencing AI recommendations in a measurable, systematic way.

Investment Strategy Implications

For investors using AI tools:

- Diversify AI sources: Don’t rely on a single model

- Consider the source: Understand potential competitive biases

- Look for consensus: Multiple models agreeing carries more weight

- Examine outliers: Investigate why one model differs significantly

Conclusion: The New Landscape of AI Bias

As AI becomes more integrated into investment research and financial decision-making, understanding these systematic biases becomes crucial. Google’s Gemini being consistently conservative on Apple stock may be the canary in the coal mine for a broader phenomenon: corporate AI models reflecting competitive interests in their investment recommendations.

This doesn’t make Gemini’s analysis wrong - Apple does face real challenges around market saturation and growth moderation. But it does suggest investors should be aware of potential competitive bias when seeking AI-powered investment advice.

The future of AI investment research lies not in finding the “best” model, but in understanding how different models’ biases can provide a more complete picture of investment opportunities and risks.

Related Analysis

Explore More AI Stock Analysis:

- Apple (AAPL) Live AI Analysis - See real-time AI model predictions and detailed breakdowns

- Tesla Stock Predictions: The Great AI Divide - Massive 85% to 300% prediction spread

- NVIDIA’s AI Future: Mixed Signals from Top AI Models - How AI models view the AI chip leader

- Bitcoin Consensus: What Top AI Models Predict - AI unanimously bullish on crypto

Understanding AI Investment Bias:

- Welcome to Hallucination Yield - Learn about systematic AI investment biases

- Goals & Methodologies - Our research approach and methodology

Methodology Note: This analysis is based on standardized prompts sent to each AI model on June 25, 2025, asking for Apple stock predictions across multiple timeframes. All models received identical prompts to ensure fair comparison.

Disclaimer: This analysis is for research purposes only and should not be considered investment advice. AI predictions should never be the sole basis for investment decisions.

Research Disclaimer

This article is for research and educational purposes only. Nothing in this content constitutes financial advice. All data and analysis should be used for research purposes only. We make no warranties about the accuracy or reliability of the information provided. Use at your own risk.