Tesla Stock Predictions: The Great AI Divide - From 85% to 300% Returns

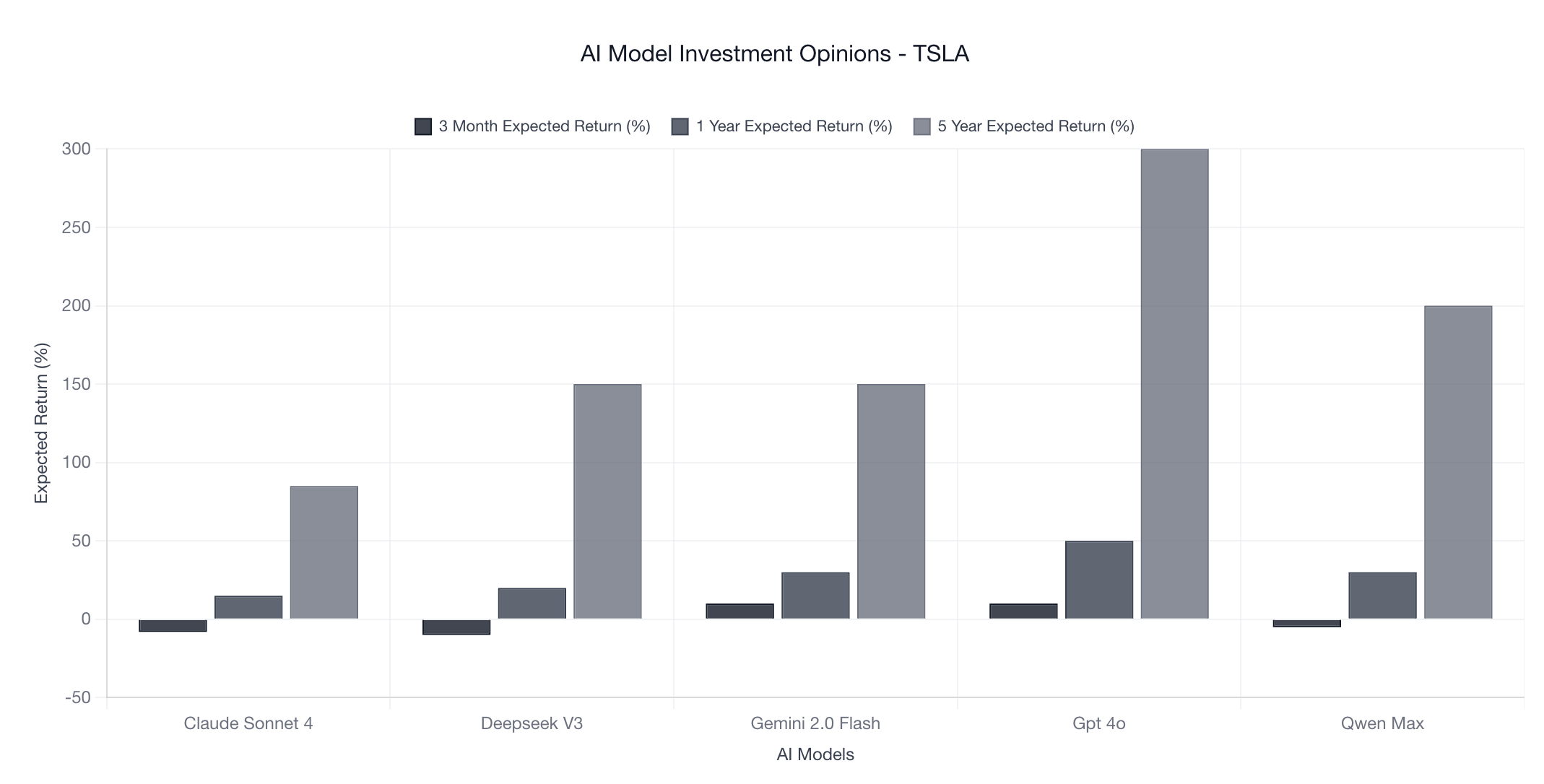

AI models show dramatic disagreement on Tesla's future, with predictions ranging from 85% to 300% over five years. GPT-4o emerges as the most bullish, while Claude shows surprising caution.

Tesla Stock Predictions: The Great AI Divide - From 85% to 300% Returns

In our latest survey of major AI models regarding Tesla (TSLA) stock, we discovered something remarkable: the widest prediction spread we’ve seen yet. While our previous analyses of Apple, NVIDIA, and Bitcoin showed varying degrees of consensus, Tesla has AI models fundamentally disagreeing about the company’s future prospects.

The numbers tell a dramatic story of AI uncertainty around one of the market’s most polarizing stocks.

The Spectacular Disagreement

Our June 23-24, 2025 analysis reveals unprecedented divergence among AI models:

5-Year Return Predictions: A 215 Percentage Point Spread

- GPT-4o: 300% total return 🚀

- Qwen-Max: 200% total return

- DeepSeek-v3: 150% total return

- Gemini 2.0: 150% total return

- Claude Sonnet-4: 85% total return ⬇️

This represents the largest prediction spread we’ve documented, with GPT-4o predicting returns 3.5 times higher than Claude’s forecast.

Across All Timeframes: The Pattern Holds

| Model | 3-Month | 1-Year | 5-Year | Bullishness |

|---|---|---|---|---|

| GPT-4o | +10% | +50% | +300% | 75 |

| Qwen-Max | -5% | +30% | +200% | 65 |

| Gemini 2.0 | +10% | +30% | +150% | 70 |

| DeepSeek-v3 | -10% | +20% | +150% | 65 |

| Claude Sonnet-4 | -8% | +15% | +85% | 65 |

Notable pattern: Most models expect near-term turbulence (negative 3-month returns) but disagree wildly on long-term prospects.

What’s Driving the Divide?

GPT-4o: The Tesla Bull

Rationale: “Strong growth potential driven by EV market expansion and technological innovation.”

GPT-4o’s extreme bullishness (300% over 5 years) suggests the model sees Tesla as fundamentally transformational, focusing on:

- Massive EV market opportunity

- Technological leadership advantage

- Innovation pipeline (AI, autonomous driving, energy)

Claude Sonnet-4: The Tesla Skeptic

Rationale: “Strong long-term positioning in EV/energy storage/AI but facing near-term margin pressure and increased competition while trading at premium valuation.”

Claude’s conservative stance (85% over 5 years) emphasizes:

- Valuation concerns at current levels

- Competitive pressure intensifying

- Margin compression risks

- Execution challenges

The Middle Ground: Cautious Optimism

DeepSeek, Gemini, and Qwen-Max cluster around 150-200% returns, acknowledging both opportunities and risks.

The Tesla Paradox: Why Such Divergence?

Tesla represents a unique challenge for AI analysis due to several factors:

1. Multi-Business Complexity

Unlike pure-play companies, Tesla operates across:

- Electric vehicles (core business)

- Energy storage and solar

- Autonomous driving technology

- Potential robotics/AI applications

- Supercharger network monetization

Each AI model may weight these businesses differently.

2. Valuation Methodology Differences

Tesla’s premium valuation can be justified through multiple lenses:

- Traditional auto metrics: Suggests overvaluation

- Tech company multiples: More supportive

- Energy/infrastructure play: Different framework entirely

- AI/robotics potential: Sky-high valuations possible

3. Execution Risk Assessment

AI models appear to differ significantly on Tesla’s execution capabilities:

- Bulls emphasize: Track record of achieving “impossible” goals

- Bears highlight: Production challenges, timeline delays, competitive threats

What This Reveals About AI Investment Analysis

Pattern Recognition vs. Fundamental Analysis

The Tesla divergence suggests AI models may be applying different analytical frameworks:

- GPT-4o: Appears more influenced by growth/innovation narratives

- Claude: Emphasizes traditional valuation metrics and risk factors

- Others: Attempt to balance multiple perspectives

Training Data Influence

The split may reflect different training data emphases:

- Bull case training: Includes Tesla’s historical success stories, innovation coverage

- Bear case training: Traditional financial analysis, competitive threats, valuation concerns

Confidence Levels Tell a Story

Notably, even the most bullish model (GPT-4o) shows only 70% confidence, while Claude shows just 58% confidence - suggesting all models recognize Tesla’s inherent unpredictability.

Comparing Tesla to Our Other Analyses

Tesla vs. Apple

- Apple: Gemini’s competitive bias created clear outlier

- Tesla: No single model appears systematically biased; divergence seems fundamental

Tesla vs. NVIDIA

- NVIDIA: Mixed signals with consensus on challenges

- Tesla: Wild disagreement on fundamental prospects

Tesla vs. Bitcoin

- Bitcoin: Unanimous AI bullishness

- Tesla: Maximum AI disagreement

Tesla emerges as the most divisive stock in our AI analysis series.

Investment Implications

For Tesla Investors

This analysis suggests:

- High uncertainty: Even AI models can’t agree on Tesla’s trajectory

- Multiple valid perspectives: Both bull and bear cases have merit

- Timeline matters: Near-term volatility expected across models

- Execution critical: Company performance will determine which AI was right

For AI-Assisted Investment Research

Tesla demonstrates:

- Model diversification essential: Single AI opinion insufficient for complex stocks

- Confidence levels matter: Low confidence suggests high uncertainty

- Industry complexity: Multi-business models challenge AI analysis frameworks

The Broader Tesla Narrative

Why Tesla Breaks AI Consensus

Tesla represents the intersection of multiple mega-trends:

- Electric vehicle adoption

- Autonomous driving development

- Energy transition

- AI/robotics revolution

- Manufacturing innovation

This complexity makes Tesla a Rorschach test for AI models - each sees different patterns based on training emphasis and analytical frameworks.

Conclusion: The Tesla Test

Tesla’s ability to generate such dramatic AI disagreement makes it a fascinating case study in the limits of AI investment analysis. While our Apple analysis revealed competitive bias and Bitcoin showed unanimous bullishness, Tesla exposes something deeper: fundamental uncertainty about the future of transformational companies.

The 85% to 300% return spread isn’t just about Tesla - it’s about how AI models handle complexity, uncertainty, and paradigm-shifting companies. For investors, Tesla serves as a reminder that even the most sophisticated AI analysis can’t eliminate the fundamental challenge of predicting transformational businesses.

Whether GPT-4o’s extreme optimism or Claude’s measured caution proves correct, one thing is certain: Tesla continues to defy easy categorization, even by artificial intelligence.

Related Analysis

Explore More AI Stock Analysis:

- Tesla (TSLA) Live AI Analysis - See real-time AI model predictions and detailed breakdowns

- Apple Stock Predictions: Why Google’s Gemini is Most Conservative - Competitive bias in AI recommendations

- NVIDIA’s AI Future: Mixed Signals from Top AI Models - How AI models view the AI chip leader

- Bitcoin Consensus: What Top AI Models Predict - Unanimous AI bullishness vs Tesla’s chaos

Understanding AI Investment Bias:

- Welcome to Hallucination Yield - Learn about systematic AI investment biases

- Goals & Methodologies - Our research approach and methodology

Methodology Note: This analysis is based on standardized prompts sent to each AI model on June 23-24, 2025, asking for Tesla stock predictions across multiple timeframes. All models received identical prompts to ensure fair comparison.

Disclaimer: This analysis is for research purposes only and should not be considered investment advice. Tesla stock is highly volatile and speculative. AI predictions should never be the sole basis for investment decisions.

Research Disclaimer

This article is for research and educational purposes only. Nothing in this content constitutes financial advice. All data and analysis should be used for research purposes only. We make no warranties about the accuracy or reliability of the information provided. Use at your own risk.