Intel (INTC): AI Models Cautiously Optimistic on Deep Value Play

Analysis of major LLM predictions for Intel reveals muted enthusiasm with 45-150% five-year returns, as AI models weigh foundry turnaround potential against fierce competition from AMD and NVIDIA.

Intel (INTC): AI Models Cautiously Optimistic on Deep Value Play

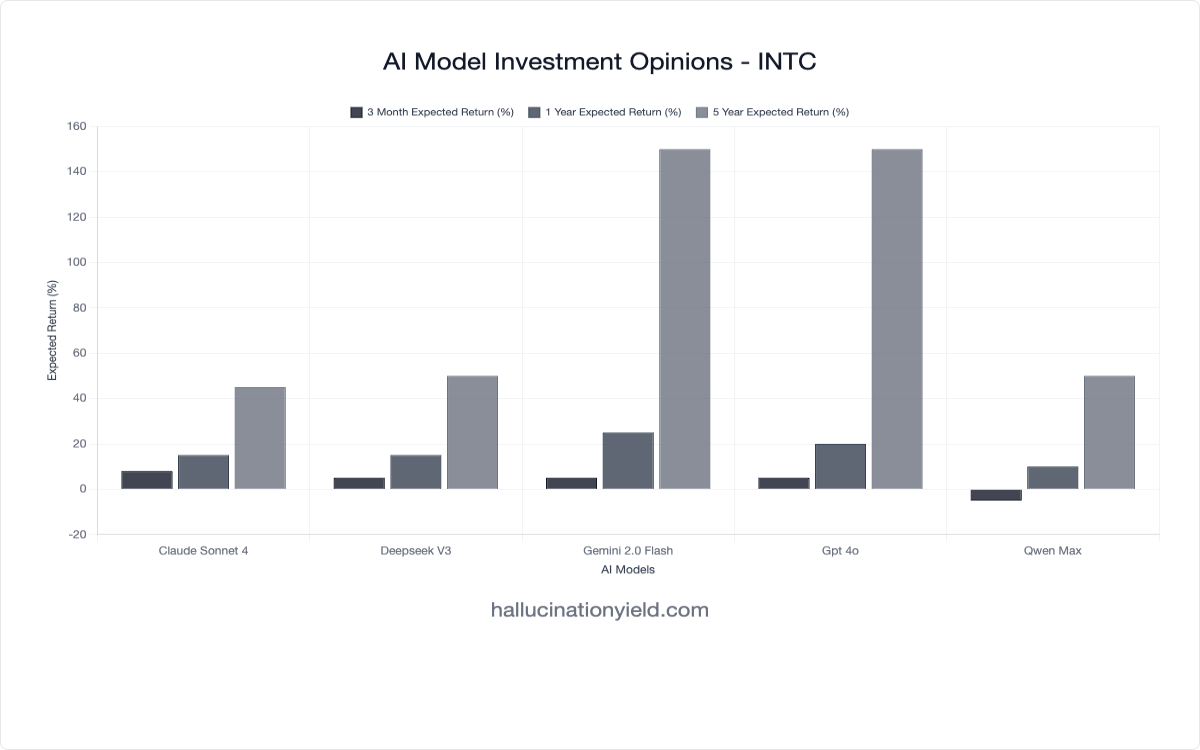

In our latest survey of leading AI models conducted July 9-10, 2025, we queried five major LLMs about Intel’s prospects across multiple timeframes. The results reveal remarkably muted enthusiasm compared to our recent space technology and AI infrastructure analyses, with predictions ranging from just 45-150% over five years - a stark contrast to the 180-400% returns predicted for companies like ASTS and RKLB.

The Turnaround Thesis Under Scrutiny

Intel represents one of the most complex investment cases in our AI sentiment research, with models grappling between the company’s deep value proposition and its competitive disadvantages. Unlike the unanimous optimism we’ve seen for emerging technologies, Intel’s predictions show extreme divergence and unusually low confidence levels.

Key Findings

| Model | 3-Month Return | 1-Year Return | 5-Year Return | Bullishness Score | Confidence |

|---|---|---|---|---|---|

| Claude Sonnet 4 | -5% | +15% | +45% | 35/100 | 0.25 |

| DeepSeek V3 | +5% | +15% | +50% | 60/100 | 0.60 |

| Gemini 2.0 Flash | +5% | +25% | +150% | 65/100 | 0.60 |

| GPT-4o | +5% | +20% | +150% | 65/100 | 0.60 |

| Qwen Max | -5% | +10% | +50% | 40/100 | 0.60 |

The Skeptical Voice: Claude Sonnet 4

Claude Sonnet 4 delivers the most bearish assessment with a confidence level of just 0.25 - the lowest we’ve recorded in our research. This reflects deep uncertainty about Intel’s ability to execute its turnaround strategy.

Claude’s Stark Analysis:

“Intel faces structural headwinds from AMD/NVIDIA competition and foundry struggles, but trades at deep value with potential AI/foundry turnaround upside over longer horizons.”

Claude identifies three critical challenges:

- Structural competitive disadvantages versus AMD and NVIDIA

- Foundry execution struggles in the IDM 2.0 strategy

- Deep value trap risk despite attractive valuation

The 35/100 bullishness score is among the lowest we’ve seen, suggesting Claude views Intel as a fundamentally challenged business model.

The Optimistic Outliers: Long-Term Value Recognition

Gemini 2.0 Flash and GPT-4o provide the most optimistic assessments, both predicting 150% returns over five years - triple Claude’s forecast. However, even these “optimistic” predictions pale compared to growth stock analyses.

Gemini’s Value Thesis:

“Intel is undervalued given its long-term potential in chip manufacturing and foundry services, despite current headwinds.”

GPT-4o’s Strategic View:

“Intel’s strategic investments in manufacturing and AI position it for moderate growth despite competitive pressures.”

Both models emphasize the deep value opportunity but acknowledge significant execution risks.

The Middle Ground: Cautious Turnaround Bets

DeepSeek V3 and Qwen Max offer more conservative assessments, clustering around 50% five-year returns - modest by technology stock standards.

DeepSeek’s Balanced Take:

“Intel’s turnaround and foundry investments may pay off long-term, but near-term execution risks remain.”

Qwen’s Strategic Focus:

“Intel’s long-term recovery hinges on execution of its IDM 2.0 strategy amidst fierce competition and macroeconomic headwinds.”

Both models emphasize the execution-dependent nature of Intel’s recovery story.

Key Themes Across All Models

Despite varying predictions, several consistent themes emerge:

1. Competitive Disadvantage Recognition

Every model acknowledges Intel’s challenges:

- AMD’s superior CPU performance and market share gains

- NVIDIA’s AI chip dominance

- TSMC’s foundry leadership

2. Foundry Strategy Uncertainty

All models mention the IDM 2.0 transition:

- Massive capital investment requirements

- Uncertain customer adoption

- Competition with established pure-play foundries

3. Deep Value Proposition

Models consistently recognize:

- Attractive valuation metrics

- Potential for mean reversion

- Strategic importance in US semiconductor manufacturing

Confidence Crisis: Unprecedented Uncertainty

The confidence levels for Intel reveal unprecedented uncertainty among AI models:

- Claude Sonnet 4: 0.25 (extremely low)

- All Others: 0.60 (moderate but not high)

This contrasts sharply with confidence levels we’ve observed for other stocks:

- RKLB: 0.60-0.70

- ASTS: 0.35-0.70

- NVIDIA: 0.68-0.80

The low confidence suggests AI models struggle with Intel’s complex turnaround narrative.

Historical Context: Value Trap or Opportunity?

To contextualize these modest predictions:

- S&P 500 Average Annual Return: ~10% (50% over 5 years)

- Intel AI Models’ 5-Year Predictions: 45-150%

- NVIDIA AI Models’ 5-Year Predictions: 180-300%

- Space Tech AI Models’ 5-Year Predictions: 180-400%

Intel’s predictions are the most conservative we’ve analyzed, reflecting mature industry dynamics and competitive challenges.

What Makes Intel Analysis Unique

This Intel survey reveals several unique patterns in AI model assessment:

1. Value vs Growth Recognition

Models show sophisticated understanding of:

- Value investment principles (deep value recognition)

- Growth investment challenges (competitive disadvantages)

- Risk-adjusted return expectations

2. Execution Risk Assessment

Unlike pure-play technology companies, models emphasize:

- Manufacturing execution complexity

- Strategic transformation challenges

- Competitive response dynamics

3. Macro Sensitivity

Models demonstrate awareness of:

- Semiconductor cycle dynamics

- Geopolitical manufacturing considerations

- Capital allocation efficiency

Sector Comparison: Intel vs Semiconductor Peers

Comparing Intel’s AI sentiment to other semiconductor analyses:

More Conservative Than NVIDIA

- Intel Bullishness: 35-65/100

- NVIDIA Bullishness: 75-85/100

- Intel 5-Year Range: 45-150%

- NVIDIA 5-Year Range: 180-300%

Lower Confidence Than Sector

Intel’s uncertainty levels suggest AI models view it as:

- More complex to analyze than pure-play AI companies

- Higher execution risk than established leaders

- Greater sensitivity to competitive dynamics

Implications for Value Investing Research

This Intel case study provides insights into AI model assessment of value turnaround plays:

Value Recognition Capability

Models demonstrate understanding of:

- Valuation metrics and mean reversion potential

- Deep value versus value trap distinction

- Risk-adjusted return expectations for challenged companies

Turnaround Skepticism

The conservative predictions suggest:

- AI models may be biased toward growth narratives

- Execution risk heavily weighted in turnaround stories

- Competitive moats more important than financial engineering

The Broader Semiconductor Context

For Intel Investors

These AI predictions highlight:

- Modest return expectations despite deep value

- High execution risk in foundry transition

- Importance of competitive positioning over valuation

For Semiconductor Research

This analysis demonstrates:

- AI models can differentiate between semiconductor business models

- Recognition of competitive dynamics in mature markets

- Understanding of capital intensity and execution challenges

What’s Next

We’ll continue tracking these Intel predictions to analyze:

- How model opinions evolve with foundry progress announcements

- Whether competitive developments affect sentiment

- If AI strategy execution changes assessment

We’re also expanding our semiconductor coverage to include AMD and other chip companies to understand broader sector sentiment patterns.

Related Analysis

Explore More Semiconductor Analysis:

- Intel (INTC) Live AI Analysis - See real-time AI model predictions and detailed breakdowns

- NVIDIA’s AI Future: Mixed Signals from Top AI Models - AI leader vs turnaround story comparison

- Compare NVDA vs AMD - Semiconductor rivalry analysis

- Compare INTC vs AMD - CPU competition sentiment

Understanding AI Investment Bias:

- Welcome to Hallucination Yield - Learn about systematic AI investment biases

- Goals & Methodologies - Our research approach and methodology

Research Methodology Note: All models were queried using identical prompts about INTC stock predictions and rationale. Responses were collected July 9-10, 2025, and represent the models’ outputs at that specific time.

Important Disclaimer: This analysis is for research purposes only. LLM predictions should not be considered investment advice. INTC stock is subject to significant volatility and risk, particularly given the competitive semiconductor landscape and execution challenges in foundry transition. Past performance and AI predictions do not guarantee future results. Always conduct your own research and consult financial professionals before making investment decisions.

Interested in our methodology or have questions about our LLM sentiment research? Contact our research team or subscribe to our newsletter for regular updates on AI market sentiment analysis.

Research Disclaimer

This article is for research and educational purposes only. Nothing in this content constitutes financial advice. All data and analysis should be used for research purposes only. We make no warranties about the accuracy or reliability of the information provided. Use at your own risk.