Rocket Lab (RKLB): AI Models Bullish on Space Economy Growth

Analysis of major LLM predictions for Rocket Lab reveals strong long-term confidence in the space launch market, with AI models predicting 180-350% returns over five years despite near-term competition concerns.

Rocket Lab (RKLB): AI Models Bullish on Space Economy Growth

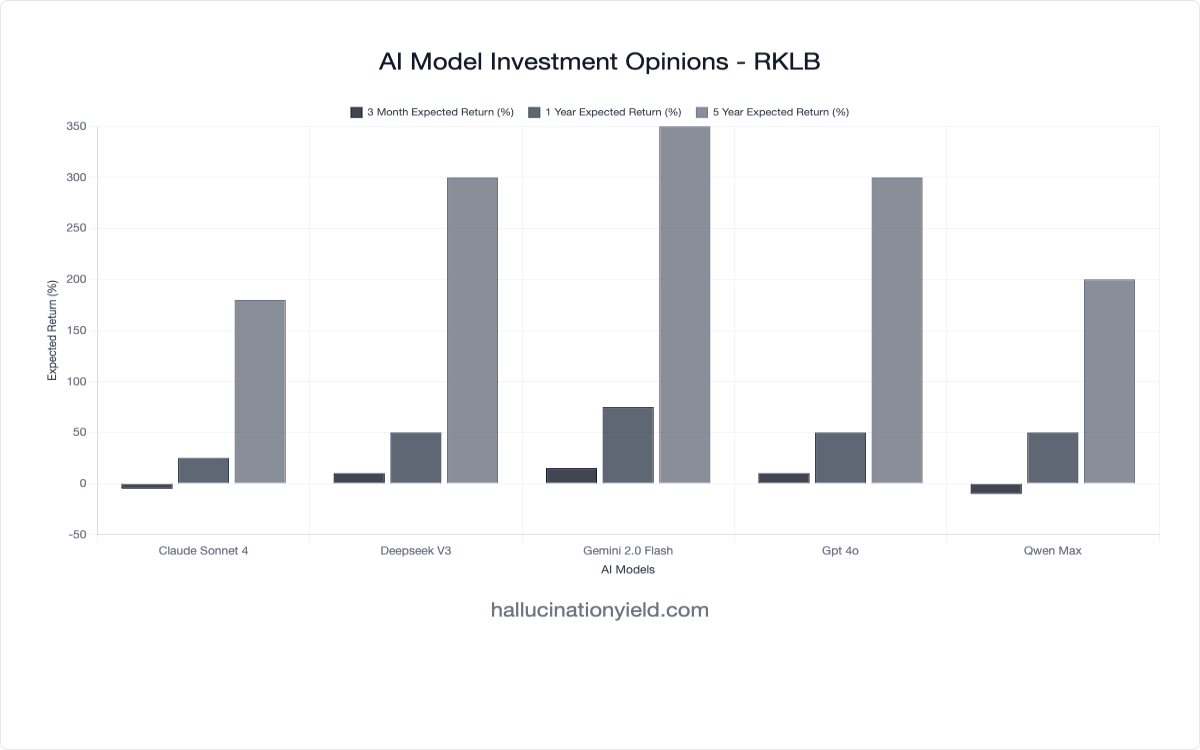

In our latest survey of leading AI models conducted June 28, 2025, we queried five major LLMs about Rocket Lab’s prospects across multiple timeframes. The results reveal strong consensus on long-term space economy growth, with AI models predicting substantial 180-350% returns over five years, though near-term execution and competitive pressures create more cautious short-term outlooks.

The Space Launch Opportunity

Rocket Lab has established itself as a key player in the small satellite launch market, with all five AI models recognizing the company’s strategic positioning in the growing space economy. Unlike the extreme volatility seen in our AST SpaceMobile analysis, RKLB predictions show more measured optimism with higher confidence levels.

Key Findings

| Model | 3-Month Return | 1-Year Return | 5-Year Return | Bullishness Score | Confidence |

|---|---|---|---|---|---|

| Claude Sonnet 4 | -5% | +25% | +180% | 72/100 | 0.65 |

| DeepSeek V3 | +10% | +50% | +300% | 75/100 | 0.70 |

| Gemini 2.0 Flash | +15% | +75% | +350% | 70/100 | 0.70 |

| GPT-4o | +10% | +50% | +300% | 75/100 | 0.60 |

| Qwen Max | -10% | +50% | +200% | 60/100 | 0.65 |

The Conservative Voice: Near-Term Headwinds

Claude Sonnet 4 and Qwen Max both predict negative returns in the 3-month timeframe, highlighting specific competitive and operational challenges facing the company.

Claude’s Analysis:

“Strong execution in small satellite launch market with expanding constellation demand, but faces near-term margin pressure and SpaceX competition.”

Qwen’s Perspective:

“Moderate long-term growth potential driven by space industry expansion, but near-term volatility and cash burn weigh on returns.”

These models identify two critical near-term concerns:

- Competitive pressure from SpaceX’s dominance

- Margin compression and cash burn issues

The Optimistic Majority: Space Economy Tailwinds

Gemini 2.0 Flash leads the optimistic camp with the most aggressive predictions, forecasting +15% in 3 months, +75% in 1 year, and +350% over 5 years. This model shows the strongest confidence in Rocket Lab’s market positioning.

Gemini’s Reasoning:

“Rocket Lab is well-positioned to capitalize on the growing space economy with its diversified launch and space systems businesses.”

DeepSeek V3 and GPT-4o align closely with identical 1-year and 5-year predictions, both emphasizing the broader space industry growth trend.

DeepSeek’s Take:

“Strong growth potential in space sector but near-term volatility expected.”

GPT-4o’s Analysis:

“Strong growth potential in the space industry with increasing launch frequency and expanding customer base.”

Key Themes Across All Models

Despite varying near-term predictions, several consistent themes emerge:

1. Space Economy Secular Growth

Every model acknowledges the expanding space market:

- Growing satellite constellation deployments

- Increasing commercial space activity

- Government and defense space spending

2. Competitive Landscape Awareness

Models consistently mention competition concerns:

- SpaceX’s market dominance

- Pressure on launch pricing

- Need for differentiation in small satellite market

3. Execution and Scale Challenges

All models recognize operational hurdles:

- Launch frequency requirements

- Margin pressure in competitive market

- Capital intensity of space operations

Confidence Analysis: Measured Optimism

The confidence levels (0.60-0.70) for RKLB are notably higher than those we observed for ASTS, suggesting AI models feel more certain about their analysis framework for the established launch services market compared to the speculative satellite constellation business.

Qwen Max’s lower bullishness score (60/100) stands out, reflecting a more conservative view of the space launch market’s growth potential relative to execution risks.

Sector Comparison: RKLB vs Space Technology Peers

Comparing these RKLB predictions to our recent ASTS analysis reveals interesting patterns:

More Conservative Than ASTS

- RKLB 5-Year Range: 180-350%

- ASTS 5-Year Range: 180-400%

- RKLB Near-Term: More negative 3-month predictions

- ASTS Near-Term: Higher volatility expectations

Higher Confidence Levels

- RKLB Confidence: 0.60-0.70

- ASTS Confidence: 0.35-0.70 (wider range)

This suggests AI models view RKLB as a more established, predictable business model compared to ASTS’s speculative satellite constellation approach.

The Business Model Advantage

Diversified Revenue Streams

Models recognize RKLB’s strategic positioning with:

- Launch services (proven revenue model)

- Space systems business (higher margins)

- Government contracts (stable demand)

Execution Track Record

Unlike purely developmental space companies, RKLB benefits from:

- Operational launch capability

- Established customer relationships

- Proven technical execution

What Makes This Analysis Different

This RKLB survey reveals several important insights about AI model assessment of space technology companies:

1. Business Model Sophistication

Models show understanding of:

- Launch services economics

- Competitive positioning versus SpaceX

- Importance of launch frequency and scale

2. Market Timing Awareness

The mix of near-term caution and long-term optimism suggests:

- Recognition of current market challenges

- Understanding of long-term space economy growth

- Appreciation for execution risk in scaling operations

3. Competitive Analysis

Models demonstrate awareness of:

- SpaceX’s competitive advantages

- Rocket Lab’s small satellite niche

- Pricing pressure in launch services

Implications for Space Technology Investing

This RKLB case study provides insights into AI model assessment of established space companies:

Execution Over Innovation

Models appear to weight:

- Proven operational capability more heavily than pure innovation

- Revenue generation over theoretical market opportunity

- Competitive positioning within existing markets

Risk-Adjusted Returns

The more measured predictions compared to ASTS suggest:

- Recognition of business model maturity

- Understanding of competitive dynamics

- Appreciation for operational execution requirements

The Broader Space Investment Context

For RKLB Investors

These AI predictions highlight:

- Strong long-term secular trends in space economy

- Near-term competitive and operational challenges

- Importance of execution in scaling launch frequency

For Space Technology Research

This analysis demonstrates:

- AI models can differentiate between space business models

- Recognition of competitive dynamics in established markets

- Understanding of execution risk versus pure opportunity

What’s Next

We’ll continue tracking these RKLB predictions to analyze:

- How model opinions evolve with quarterly earnings

- Whether launch frequency milestones affect sentiment

- If competitive developments change AI assessments

We’re also expanding our space technology coverage to include other launch providers and satellite companies to understand broader sector sentiment patterns.

Related Analysis

Explore More Space Technology Analysis:

- Rocket Lab (RKLB) Live AI Analysis - See real-time AI model predictions and detailed breakdowns

- Compare RKLB vs ASTS - Side-by-side space technology comparison

- AST SpaceMobile (ASTS): AI Models Split on High-Risk Space Play - Satellite constellation vs launch services

- NVIDIA’s AI Future: Mixed Signals from Top AI Models - AI infrastructure vs space technology sentiment

Understanding AI Investment Bias:

- Welcome to Hallucination Yield - Learn about systematic AI investment biases

- Goals & Methodologies - Our research approach and methodology

Research Methodology Note: All models were queried using identical prompts about RKLB stock predictions and rationale. Responses were collected June 28, 2025, and represent the models’ outputs at that specific time.

Important Disclaimer: This analysis is for research purposes only. LLM predictions should not be considered investment advice. RKLB stock is subject to significant volatility and risk, particularly given the competitive nature of the space launch market. Past performance and AI predictions do not guarantee future results. Always conduct your own research and consult financial professionals before making investment decisions.

Interested in our methodology or have questions about our LLM sentiment research? Contact our research team or subscribe to our newsletter for regular updates on AI market sentiment analysis.

Research Disclaimer

This article is for research and educational purposes only. Nothing in this content constitutes financial advice. All data and analysis should be used for research purposes only. We make no warranties about the accuracy or reliability of the information provided. Use at your own risk.