AST SpaceMobile (ASTS): AI Models Split on High-Risk Space Play

Analysis of major LLM predictions for AST SpaceMobile reveals extreme optimism for long-term satellite opportunity but concerns over near-term execution risks and capital intensity.

AST SpaceMobile (ASTS): AI Models Split on High-Risk Space Play

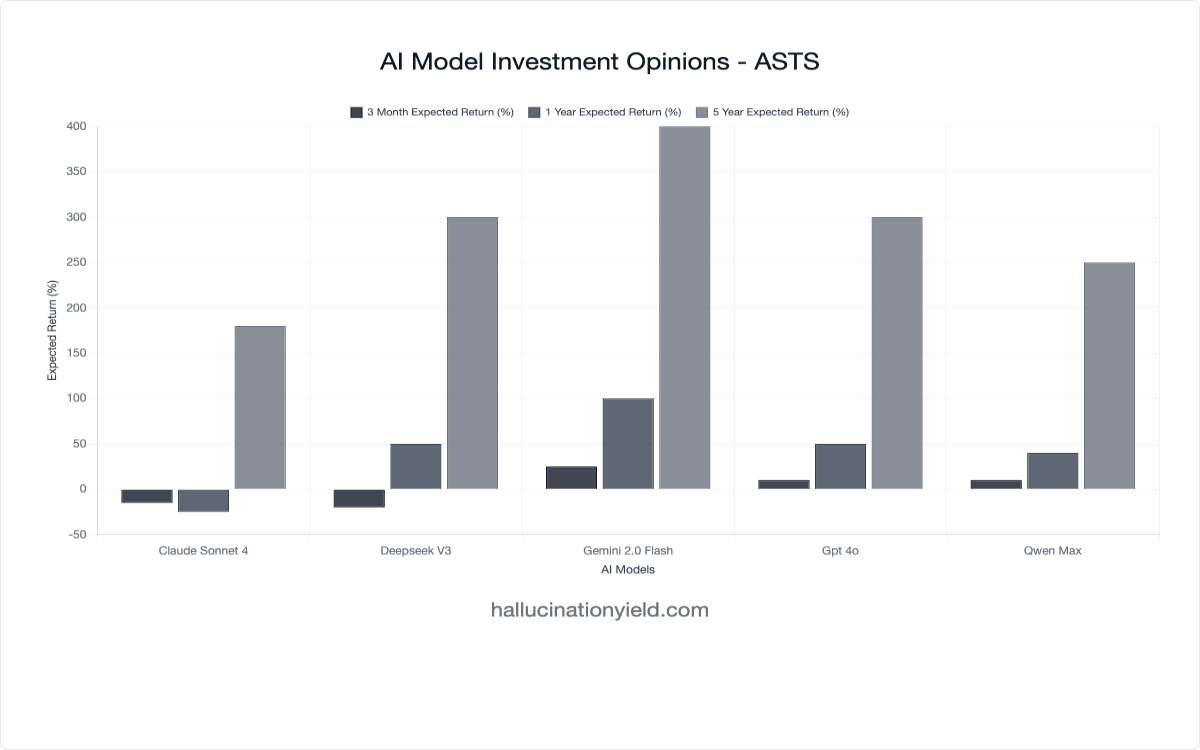

In our latest survey of leading AI models conducted June 29, 2025, we queried five major LLMs about AST SpaceMobile’s prospects across multiple timeframes. The results reveal extreme bullish sentiment for the long term, with AI models predicting massive 180-400% returns over five years, but significant near-term volatility concerns dominate the shorter timeframes.

The Space Opportunity Thesis

AST SpaceMobile represents one of the most ambitious plays in the emerging space-based cellular communication market. All five AI models recognize the massive total addressable market (TAM) but diverge significantly on execution timelines and risks.

Key Findings

| Model | 3-Month Return | 1-Year Return | 5-Year Return | Bullishness Score | Confidence |

|---|---|---|---|---|---|

| Claude Sonnet 4 | -15% | -25% | +180% | 72/100 | 0.35 |

| DeepSeek V3 | -20% | +50% | +300% | 65/100 | 0.60 |

| Gemini 2.0 Flash | +25% | +100% | +400% | 70/100 | 0.70 |

| GPT-4o | +10% | +50% | +300% | 70/100 | 0.60 |

| Qwen Max | +10% | +40% | +250% | 70/100 | 0.65 |

The Pessimistic Voice: Claude Sonnet 4

Claude Sonnet 4 stands out with the most bearish near-term outlook, predicting -25% returns over the next year and the lowest confidence level at just 0.35. This reflects deep skepticism about execution in the near term.

Claude’s Reasoning:

“High-risk space-based cellular play with massive TAM but facing execution risk, regulatory hurdles, and capital intensity in near-term before potential commercial breakthrough.”

This analysis highlights three critical risk factors:

- Execution risk in deploying satellite constellation

- Regulatory hurdles across multiple jurisdictions

- Capital intensity before revenue generation

The Optimistic Outlier: Gemini 2.0 Flash

On the opposite end, Gemini 2.0 Flash provides the most aggressive predictions, forecasting +25% in 3 months, +100% in 1 year, and +400% over 5 years. This model shows the highest confidence in near-term execution.

Gemini’s Take:

“ASTS has high potential but faces execution risk in deploying its satellite constellation.”

Despite acknowledging execution risks, Gemini appears most optimistic about the company’s ability to navigate near-term challenges.

The Middle Ground: Balanced Risk Assessment

DeepSeek V3, GPT-4o, and Qwen Max offer more measured assessments that acknowledge both the transformative potential and significant risks:

DeepSeek V3’s Perspective:

“High-risk, high-reward satellite play with speculative upside but near-term volatility.”

GPT-4o’s Analysis:

“Innovative satellite technology with high growth potential but faces execution risks.”

Qwen Max’s View:

“ASTS benefits from strong secular tailwinds in aerospace and defense, though near-term macro uncertainty tempers upside.”

Key Themes Across All Models

Despite varying short-term predictions, several consistent themes emerge:

1. Massive Long-Term Market Opportunity

Every model acknowledges the transformative potential of:

- Space-based cellular connectivity

- Global coverage for underserved markets

- Partnership opportunities with major carriers

2. Execution Risk Dominates Near-Term

All models consistently mention execution challenges:

- Satellite deployment complexity

- Technology validation requirements

- Regulatory approval processes

3. Capital Intensity Concerns

Models show awareness of funding challenges:

- High upfront investment requirements

- Lengthy development timelines

- Revenue generation timeline uncertainty

The Confidence Gap

Claude Sonnet 4’s confidence of just 0.35 stands out as remarkably low compared to other models (0.60-0.70). This suggests:

- Greater awareness of space technology execution risks

- More conservative assessment of regulatory timelines

- Heightened sensitivity to capital market conditions

Historical Context: Space Technology Investments

To contextualize these predictions, it’s worth noting the historically volatile nature of space technology investments:

- Traditional Telecom Growth: 5-10% annually

- Space Technology Sector: Highly volatile, boom-bust cycles

- AI Models’ ASTS 5-Year Predictions: 180-400% total

- Comparable Satellite Plays: Mixed historical performance

The extreme optimism for 5-year returns reflects the models’ recognition that successful execution could create an entirely new market category.

What Makes ASTS Analysis Unique

This ASTS survey reveals several interesting patterns in AI model analysis:

1. Technology Risk Assessment

Models show sophisticated understanding of:

- Complex satellite deployment challenges

- Regulatory approval processes

- Capital market dependencies

2. Market Size Recognition

All models acknowledge the massive TAM for:

- Global cellular coverage

- Underserved market connectivity

- Emergency communication services

3. Timeline Sensitivity

The dramatic difference between near-term pessimism and long-term optimism suggests:

- Models understand technology development timelines

- Recognition of binary success/failure outcomes

- Appreciation for first-mover advantages

Implications for Space Technology Investing

This ASTS case study provides insights into AI model assessment of emerging technologies:

High-Risk, High-Reward Recognition

The models demonstrate understanding that ASTS represents:

- Potential category-defining opportunity

- Significant execution and regulatory risks

- Binary outcome probability (massive success or failure)

Capital Market Awareness

Unlike some technology analyses, ASTS predictions show:

- Recognition of funding requirements

- Understanding of development timelines

- Sensitivity to market conditions

The Broader Space Technology Context

For ASTS Investors

These AI predictions highlight:

- Enormous long-term potential if execution succeeds

- Significant near-term volatility and risk

- Importance of risk management and position sizing

For Space Technology Research

This analysis demonstrates:

- AI models can assess complex technology risks

- Recognition of regulatory and execution challenges

- Understanding of market timing importance

What’s Next

We’ll continue tracking these ASTS predictions to analyze:

- How model opinions evolve with satellite deployment milestones

- Whether regulatory approval affects sentiment

- If capital raising events impact confidence levels

We’re also expanding our space technology coverage to include other satellite constellation plays to understand broader sector sentiment patterns.

Related Analysis

Explore More AI Stock Analysis:

- AST SpaceMobile (ASTS) Live AI Analysis - See real-time AI model predictions and detailed breakdowns

- NVIDIA’s AI Future: Mixed Signals from Top AI Models - Valuation concerns vs secular growth

- Tesla Stock Predictions: The Great AI Divide - Massive 85% to 300% prediction spread

- Bitcoin Consensus: What Top AI Models Predict - Unanimous AI bullishness vs space technology skepticism

Understanding AI Investment Bias:

- Welcome to Hallucination Yield - Learn about systematic AI investment biases

- Goals & Methodologies - Our research approach and methodology

Research Methodology Note: All models were queried using identical prompts about ASTS stock predictions and rationale. Responses were collected June 29, 2025, and represent the models’ outputs at that specific time.

Important Disclaimer: This analysis is for research purposes only. LLM predictions should not be considered investment advice. ASTS stock is subject to significant volatility and risk, particularly given the early-stage nature of space-based cellular technology. Past performance and AI predictions do not guarantee future results. Always conduct your own research and consult financial professionals before making investment decisions.

Interested in our methodology or have questions about our LLM sentiment research? Contact our research team or subscribe to our newsletter for regular updates on AI market sentiment analysis.

Research Disclaimer

This article is for research and educational purposes only. Nothing in this content constitutes financial advice. All data and analysis should be used for research purposes only. We make no warranties about the accuracy or reliability of the information provided. Use at your own risk.